Overview

In a landscape where innovation never sleeps, the blockchain ecosystem has rapidly transformed over the last quarter.

This report, jointly presented by QuickNode, a leading Web3 infrastructure and developer platform, and Artemis, an institutional data platform for digital assets, provides an insightful perspective on the sweeping commercial advancements observed across different chains and industry sectors.

This report provides a comprehensive overview of current blockchain activity by examining the following:

- Where is daily user activity growing the most?

- What are the most exciting chain developments?

- What are the next big trends to watch?

By centering the narrative around blockchain developers and end users, we gain valuable insights into the roadmap for building a sustainable and rapidly expanding web3 ecosystem. These insights, combined with the context of product launches and investments, give us a comprehensive story of where we're heading.

Key Takeaways

Standout narratives from Q1

Standout narratives from Q1

- Impending stablecoin surge - There has been a huge 42% QoQ surge in stablecoin user activity owing to a confluence of factors such as spot Bitcoin ETF approval and listings, the next Bitcoin halving in April, an exodus from hyperinflated fiat currencies, and DeFi's resurgence.

- DeFi Summer part 2 - In Q1'24, DeFi entered a new era characterized by renewed optimism, risk awareness, and refined innovation. A substantial 291% QoQ rise in user activity has roused hopes of a second ‘DeFi Summer’ as there are signals for growth and a transformative shift despite the SEC’s best efforts.

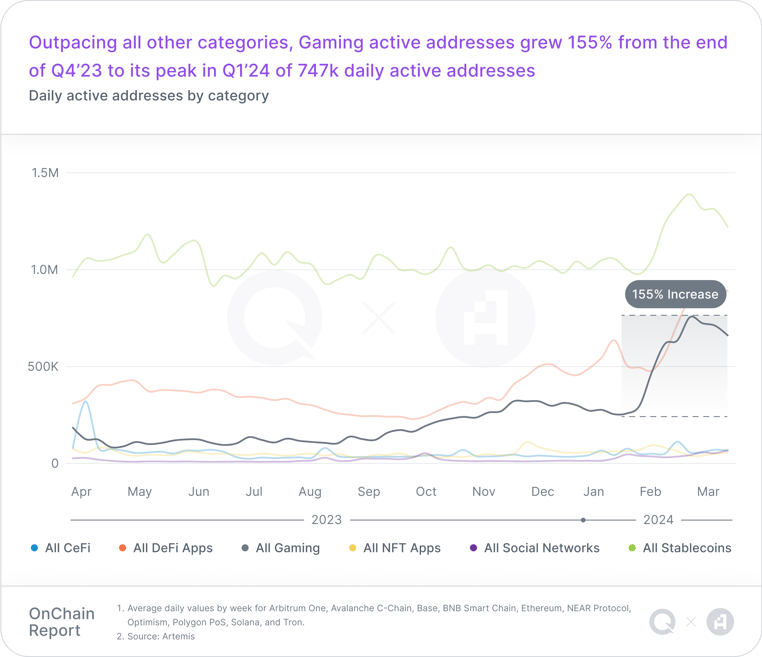

- Web3 gaming levels up - Web3 gaming was a surprise standout category in Q1’24, with a massive 155% QoQ increase in active addresses. This significant surge in player engagement showcases web3’s ability to attract and retain a growing player base.

- Layer 2s becoming number one - A rapid expansion of Layer 2s marked a critical step forward for web3 proliferation over the last 6 months. In particular, the substantial TVL growth of platforms like Arbitrum and Base showcases there’s still an appetite to expand on-chain liquidity.

Where is daily user activity growing the most?

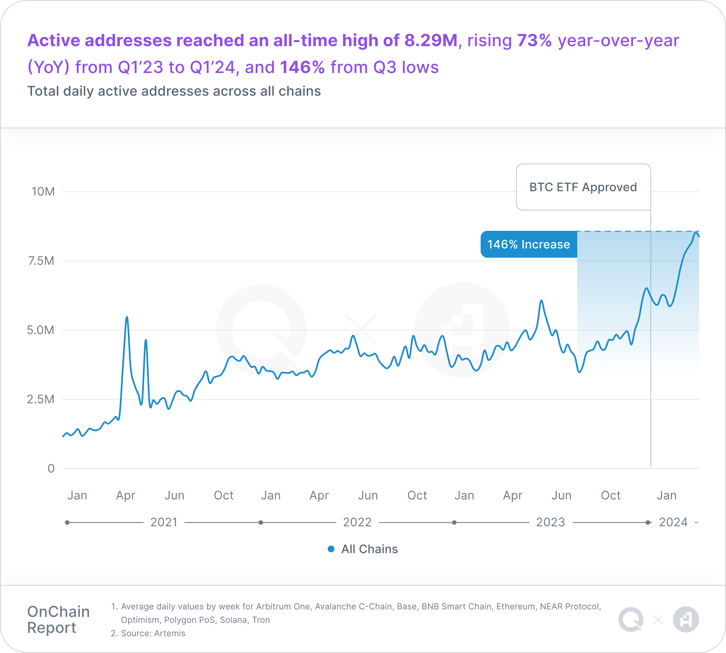

As we dive into the blockchain landscape and survey the state of user activity, it's clear that the web3 ecosystem is growing, categories are evolving, and 2024 has started with a bang.

Daily Active Addresses (DAA) - Why we use this

By tracking daily active addresses—our primary measure of usage and activity—we can get a more detailed picture of the overall macro trends and a better micro understanding of the areas where user activity is growing the most.

Top sectors with the fastest-growing DAA:

- Stablecoins have had the most active addresses overall for five quarters in a row, and in Q1'24, they represented >41% of all DAA, further cementing their role as the backbone of value transfer on the blockchain.

- Web3 Gaming, on the other hand, has burst onto the scene with an explosion of user activity, with gaming DAA growing 155% QoQ. Game developers in web3 are harnessing blockchain technology to redefine modern gaming experiences, integrate ownership, and leverage financial incentives in ways previously unimaginable.

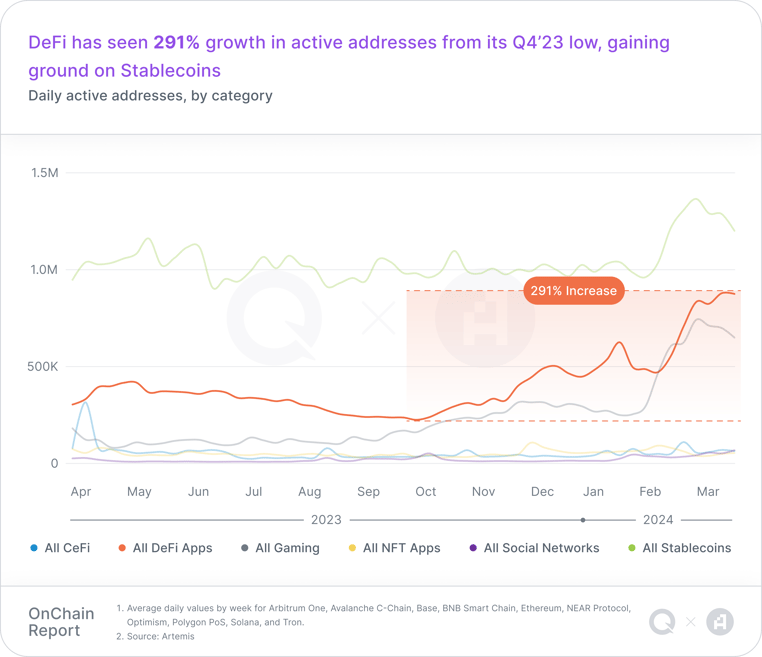

- DeFi has seen significant gains in DAA recently, growing 291% QoQ. This growth represents a resurgence of capital inflow and the emergence of new yield-generating protocols, which have opened the floodgates for user activity growth and point to an exciting year ahead for the space.

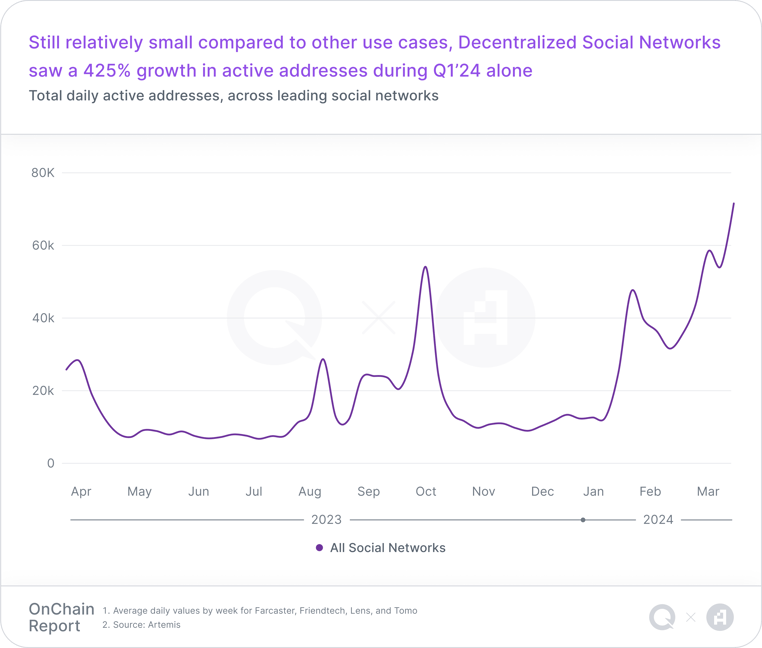

- Decentralized Social platforms, while relatively small, have spiked in activity with a 425% QoQ growth in DAA. Social DApps have started making noticeable ripples as an alternative to traditional social media by offering users control over their data and a share in the platforms' success.

DeFi

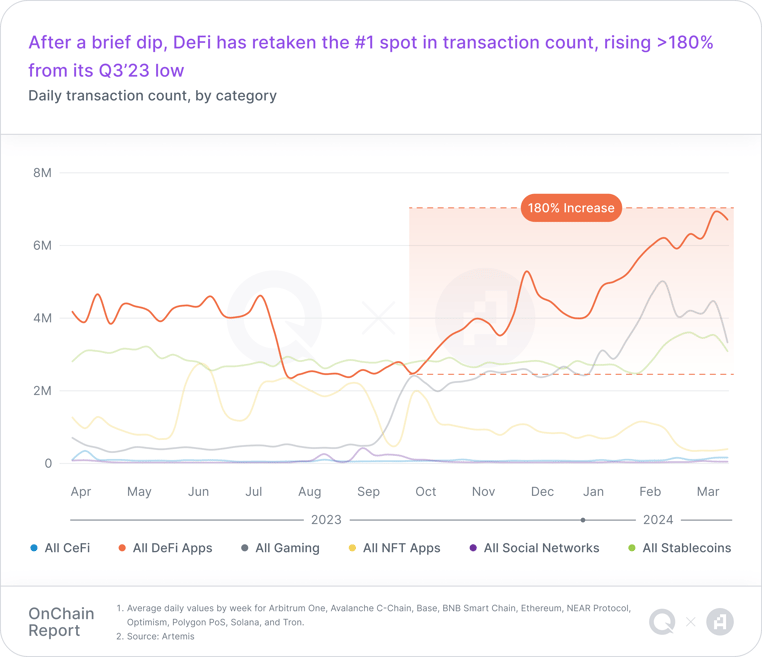

- DeFi is one of the hottest areas right now, having passed stablecoins in transactions and ending the quarter with ~7M daily transactions.

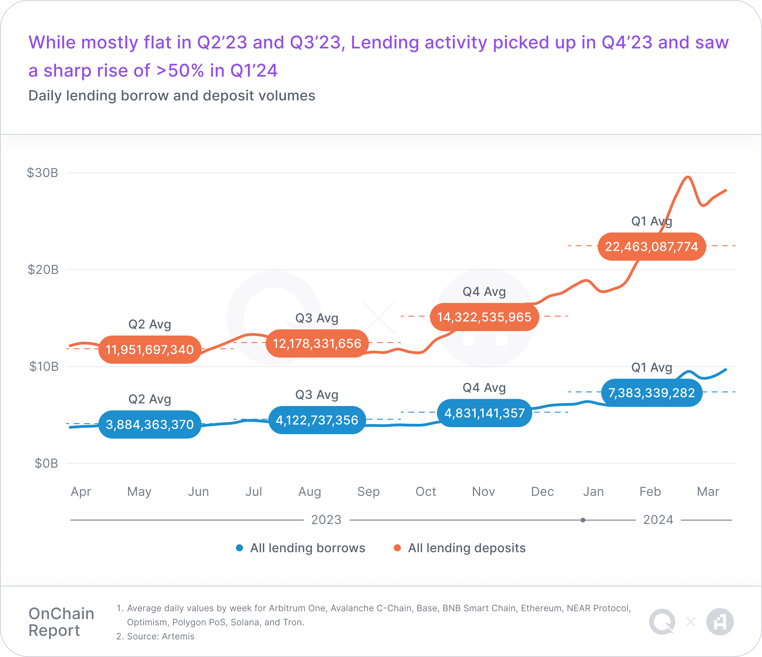

- All of the major DeFi protocol categories, such as Liquid Staking, Lending, Bridges, Yield, and Derivatives, saw their total value locked (TVL) double or even triple during Q1’24.

Gaming

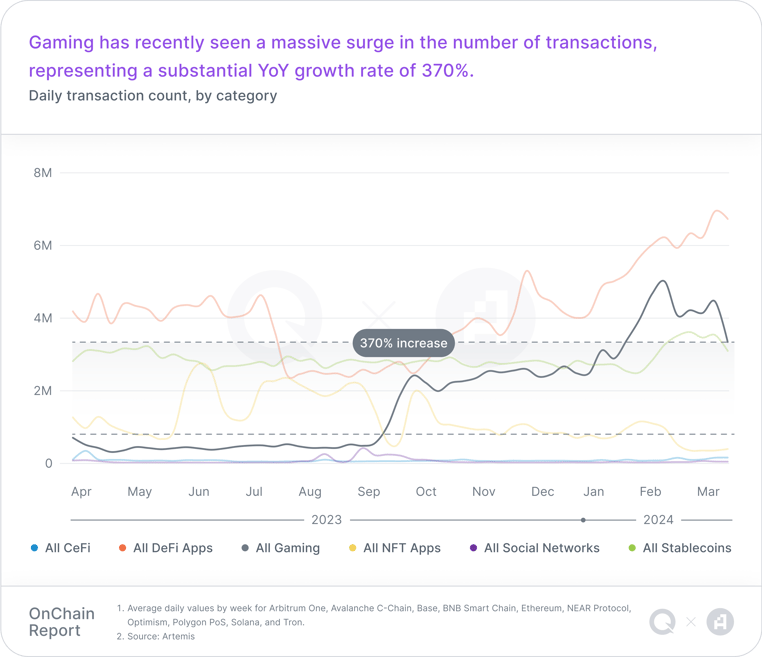

- Web3 gaming has experienced remarkable growth, surpassing stablecoins in transaction volume, and emerging as the category with the highest year-over-year (YoY) growth.

- Gaming has also seen solid growth in active users, indicating a surge in player engagement and participation.

Enjoying the report?

Sign up for email updates on the evolving Web3 landscape.

Stablecoins

Stablecoins are a type of cryptocurrency designed to minimize volatility by being pegged to a stable asset or a group of assets, often reserve-backed currencies like the US dollar or other commodities such as gold.

Key takeaways: Stablecoins

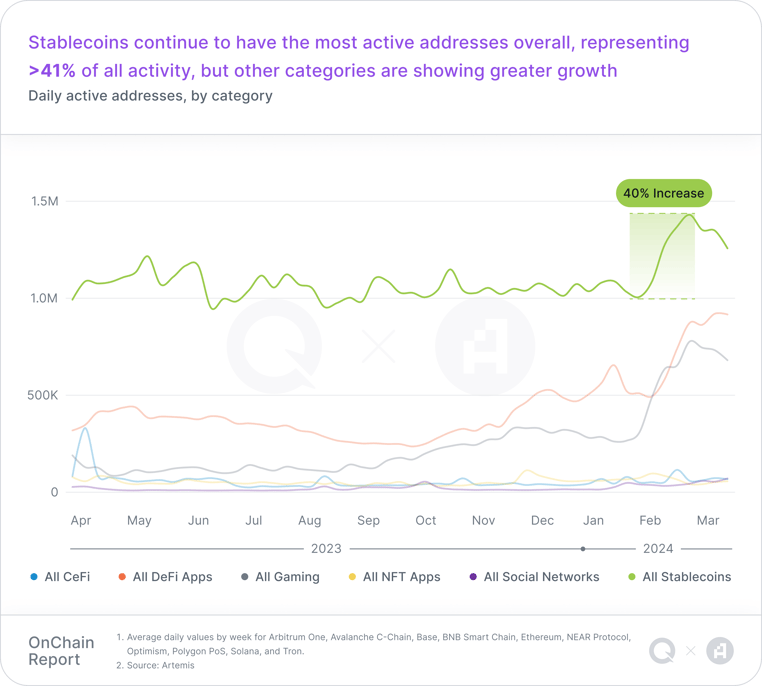

- Stablecoins continue to be the leader in daily active users across all categories, representing >41% of all web3 user activity, but some other categories saw higher QoQ activity growth and could be catching up.

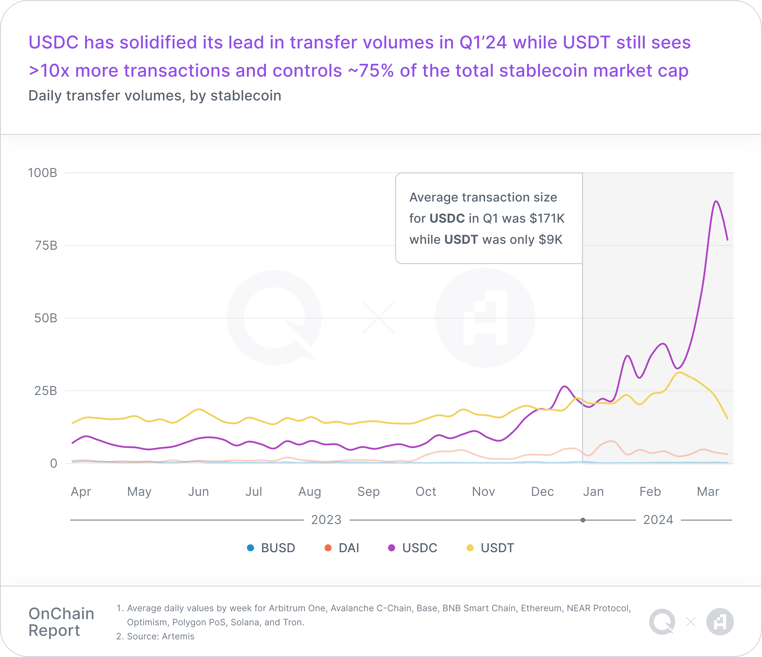

- USDT continues to dominate the stablecoin category, controlling ~75% of the total stablecoin market cap. In Q1'24, USDT hit a market cap of >$100B for the first time, becoming the fifth crypto asset to do so after Bitcoin, Ethereum, Binance Coin, and Ripple.

- Despite UDST processing more than 10 times the number of transactions as USDC in Q1’24, USDC recently took the lead in volume and average transaction size. This is partially due to Coinbase's Q1’24 efforts to further integrate USDC on their platform and propagate USDC on their L2 network, Base, by subsidizing fees.

Highlights: Stablecoins

Stablecoins continued to lead daily active users compared to all other categories in Q1’24, marking a year of stablecoin dominance since claiming the lead from DeFi in Q1’23, which had been the user activity leader in years prior.

As we noted in the Q3’23 OnChain Report, the rise of stablecoins and the slight decline of DeFi in 2023 can be directly attributed to their inherent stability and value predictability. These benefits make stablecoins attractive entry points for new and seasoned users, especially during uncertain market periods, like 2023.

Now, in Q1’24, there has been a massive surge in stablecoin user activity, owing to a confluence of factors such as spot Bitcoin ETF approval and listings, Bitcoin’s next halving in April, more regulatory clarity likely coming soon, the exodus from hyperinflated fiat currencies, the rising popularity of low-volatility assets, and the relative strength of the USD, which >90% of stablecoin transactions are anchored to.

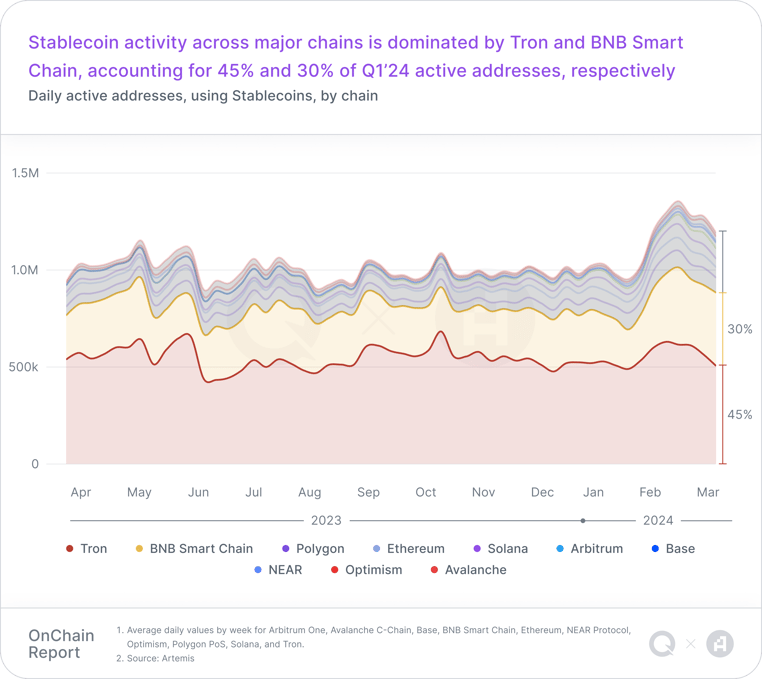

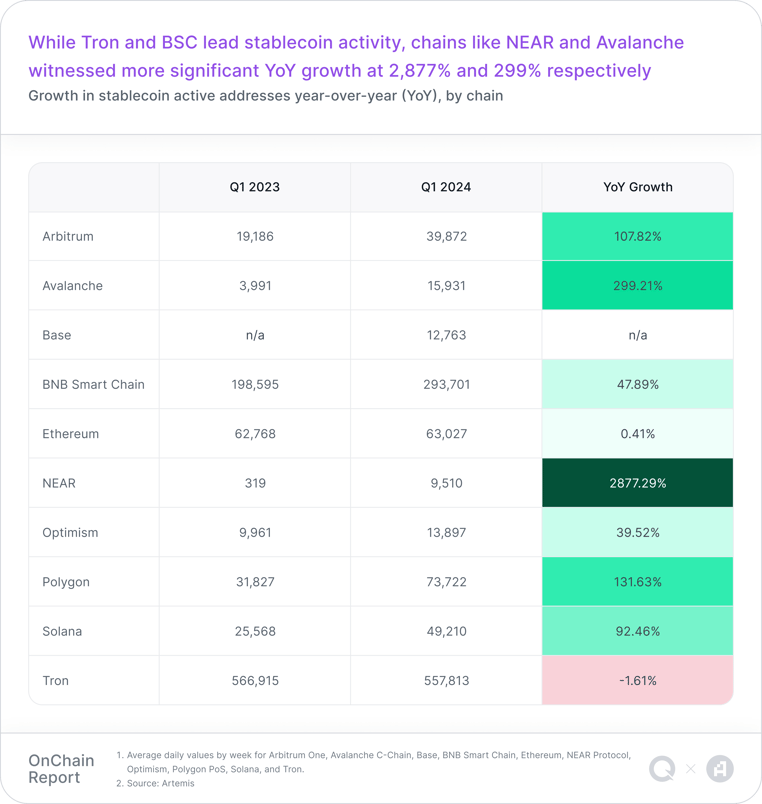

Tron

- Tron ranks #2 in overall stablecoin market cap at $55B, trailing ETH's $81B.

- Tron ranks #1 for USDT, with 50.2% of all USDT circulating on Tron. USDT is also dominant on Tron, representing 98.1% of all stablecoins. In our Q3’23 report, USDT was only 92%.

- USDC left Tron in Q1’24 as Circle announced discontinued support for USDC on Tron.

- TUSD also left Tron as it struggled to maintain a dollar peg and Binance announced delisting.

USDC

- In Q1’24, USDC gained $10B in market cap and 3% in overall stablecoin dominance, solidifying its #2 position. In comparison, USDT lost dominance despite 5x USDC’s market cap.

- Base exploded on USDC in Q1’24, going from 0.6% to >5% of the circulating supply. This corresponds to Coinbase announcing it will store corporate and customer USDC balances on Base, and the Q3’23 news about Coinbase's stake in Circle and, by extension, USDC.

- Circle, the issuer of USDC, filed for an IPO the day after the SEC approved spot Bitcoin ETFs, indicating their confidence in the retail market potential for stablecoins.

Decentralized Finance (DeFi)

A blockchain-based ecosystem enabling direct financial transactions and services, eliminating traditional intermediaries, and giving users full control of their assets.

Key takeaways: DeFi

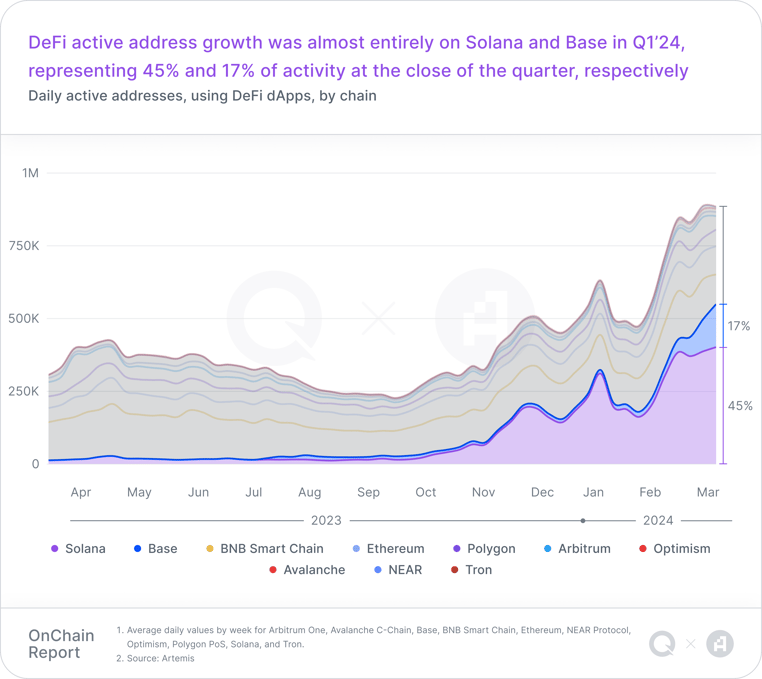

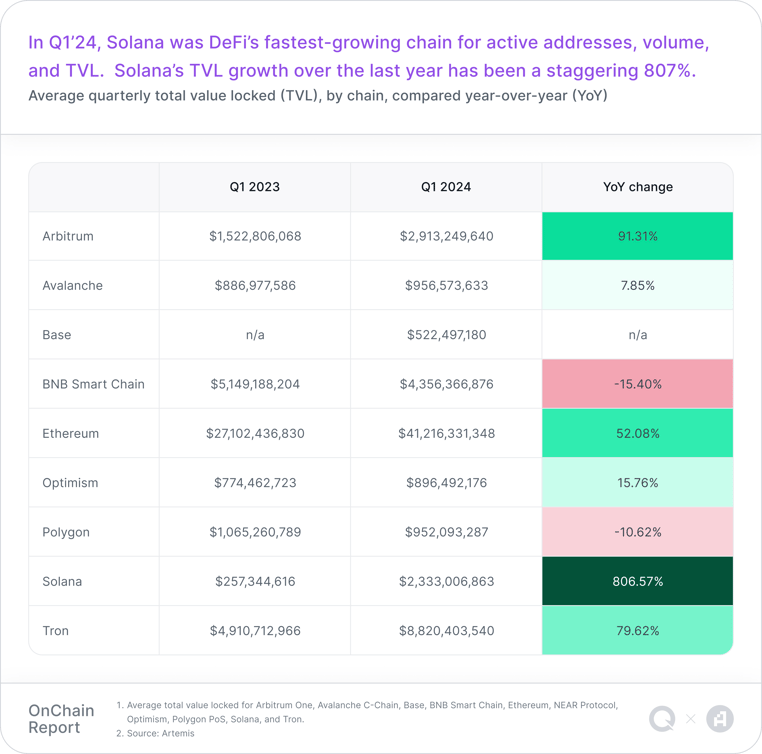

- DeFi truly entered a new era in Q1’24, characterized by renewed optimism and refined innovation. A substantial rise in developer and user activity, especially on Solana and Base, roused growing hopes of a second ‘DeFi Summer.’

- Staking, Liquid Staking, Restaking, and Liquid Restaking have all been catalysts of DeFi’s recent explosive growth, which explains why staking now represents a large portion of DeFi's TVL.

- While stablecoins still hold the top spot for address activity, DeFi actually passed stablecoins in another important metric area: transaction counts. DeFi was easily the leader in transactions for Q1’24, ending the quarter with nearly 7M average daily transactions.

- DeFi was also far and away the leader in fees spent, gas usage, and overall number of projects, despite only representing ~4% of the total crypto market cap.

- TVL for yield-generating protocols has steadily climbed from $26.5B in Q3’23 to $59.7B in Q1’24. This rally clearly signals a return of confidence and liquidity to the DeFi markets.

Highlights: DeFi

For the first time since late 2021, DeFi has truly been thriving.

All of the major DeFi protocol categories, such as Liquid Staking, Lending, Bridges, Yield, and Derivatives, saw their total value locked (TVL) double or even triple during Q1’24, something that’s not happened since 2021. What’s more, Liquid Staking and Derivatives have already exceeded their previous TVL all-time highs from 2021, indicating there’s real potential for a second ‘DeFi Summer’ in 2024.

DeFi’s hot new emerging protocol categories, such as Restaking, Liquid Restaking, Real World Assets (RWAs), and Launchpads, absolutely exploded onto the scene in Q1’24. In the span of a few months, they quickly amassed billions of TVL each and easily broke into the top DeFi protocol categories.

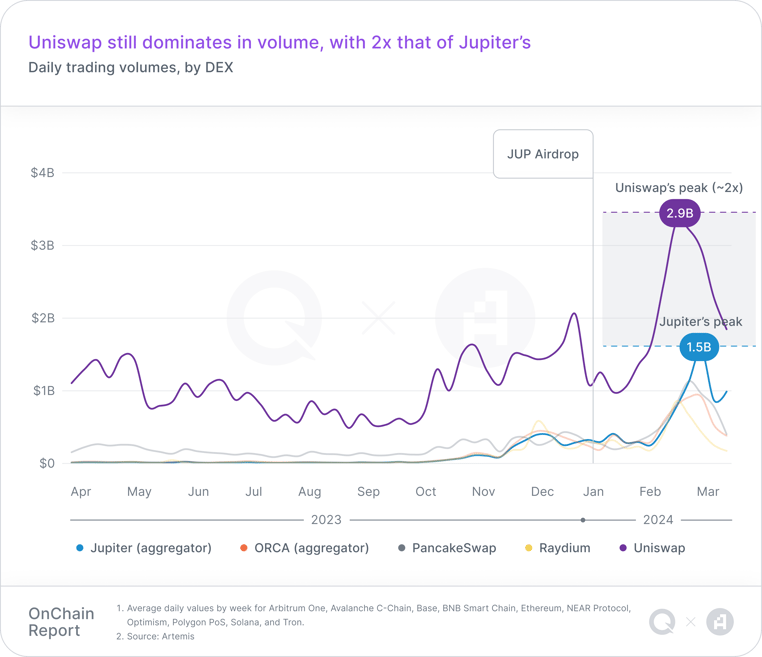

Decentralized Exchanges (DEXs) have been having a true breakout moment and were one of the most promising trends in Q1’24, especially on disruptive chains like Solana and Base.

The resurgence of capital inflow and the emergence of new yield-generating protocols has truly opened the floodgates for DeFi’s growth and points to an exciting year ahead for the space.

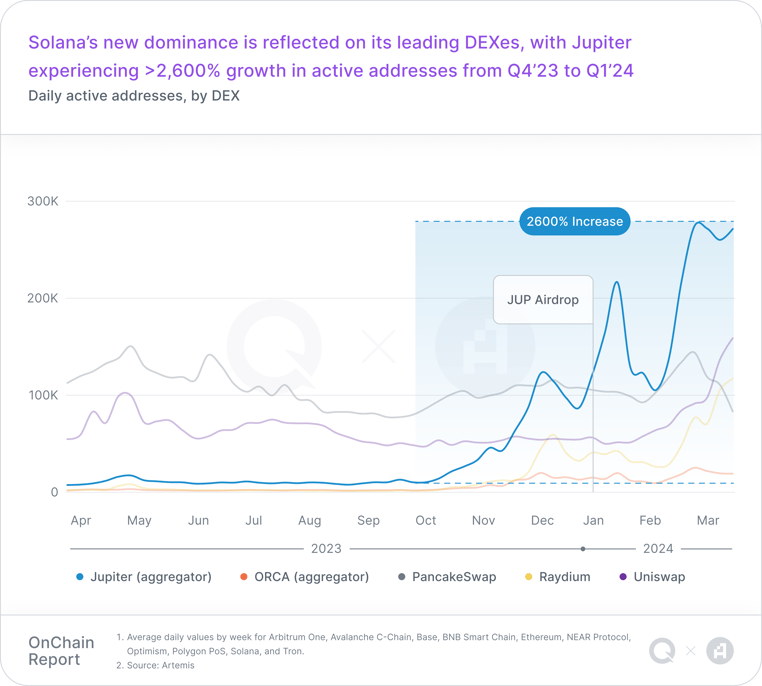

Jupiter

- Jupiter, a DEX aggregator on Solana, facilitated one of the most significant token distributions ever when it airdropped $700MM in its native JUP token to nearly a million wallets.

- During the first 24 hours after the airdrop, Jupiter recorded $1.2B in volume, nearly $300M more than Uniswap during the same period.

- Jupiter is spearheading a new era with its Jupiter DAO announcement, kickstarting it with an impressive $137 million in initial capital.

Uniswap

- Uniswap expanded the chain support for its v2 protocol midway through Q1’24.

- A month after expanding v2 support, Uniswap saw a 4,857% increase in active addresses on Base alone. Base also represents the largest number of users on Uniswap, with 54% of active addresses.

- Uniswap reported that the number of monthly swappers on Optimism and Base has doubled in the last year.

Web3 Gaming

Web3-based gaming marks a significant departure from conventional gaming platforms by offering players the opportunity to interact with games in unique and decentralized ways. Anyone can play to earn rewards through cryptocurrencies and NFTs, democratizing the entire gaming experience and transferring primary control to the players, rather than centralizing it under a single authoritative entity within the game.

Key takeaways: Web3 Gaming

- Web3 gaming has experienced remarkable growth, surpassing stablecoins in transaction volume and emerging as a web3 category with the highest year-over-year (YoY) growth.

- The sector has achieved a staggering 155% growth in active addresses in Q1’24 compared to the end of Q4’23, peaking at 747K daily active addresses, indicating a surge in player engagement and participation.

- The number of transactions within web3 gaming have grown astronomically by 370% YoY, highlighting the sector's explosive popularity and the increasing player base's willingness to transact within these ecosystems.

Highlights: Web3 Gaming

Web3 gaming emerged as the surprise standout sector in the Q1’24 onchain report, not only surpassing stablecoins in transaction volume but also achieving the highest YoY active address growth across all categories with a 155% increase in active addresses. This highlights a significant surge in games offered and player engagement.

The key factor of this explosive growth is the continued proliferation of increasingly innovative games, which showcases the sector's ability to attract and retain a growing player base through unique, decentralized gaming experiences. This can be seen in the diverse range of breakout games garnering attention, and a steadily rising amount of capital investment into the gaming category QoQ.

Matr1x

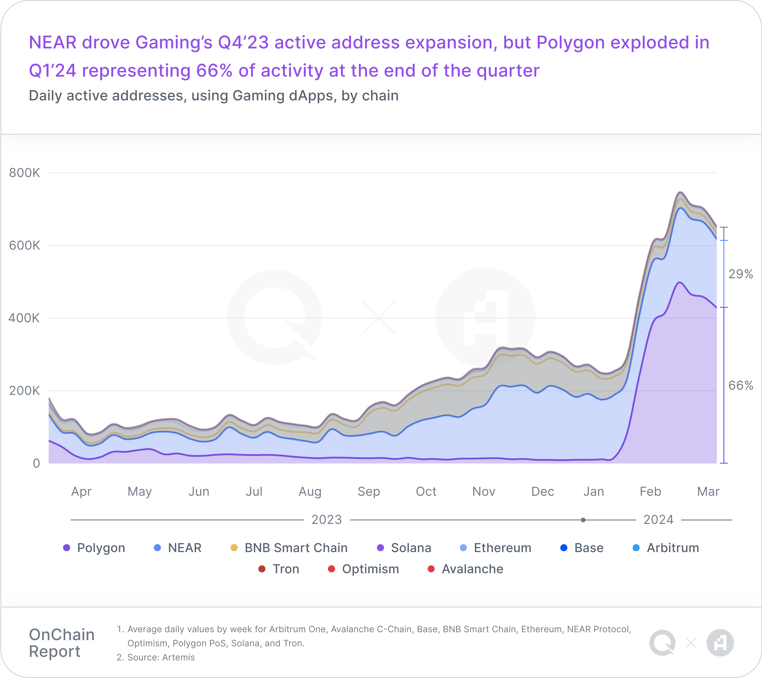

- Described as blending web3 + AI + eSports, the innovative mobile first-person shooter game, Matr1x, was the main driver of Polygon’s Q1’24 active address growth in gaming.

- Matr1x closed out the quarter with 423K active addresses, hit a quarterly peak of 614K active addresses, and has been consistently above 400K active addresses for almost all of March 2024.

Star Atlas

- Combining MMO elements with Solana NFTs and tokens for a unique blend of building and exploration within a play-to-earn framework, Star Atlas has gained recent success with a surge in gas usage and transactions in Q1’24.

- Star Atlas averaged 11.8% of Solana’s daily transactions in Q1’24, hitting a high of 16.2%, which is impressive given that Solana had by far the most transactions of any major chain featured in this report, averaging 54.6% of all daily transactions alone.

Decentralized Social

Decentralized social applications are peer-to-peer platforms that facilitate direct interactions and exchanges between users without intermediaries, using blockchain technology to ensure transparency, security, and data ownership.

Key takeaways: Social DApps

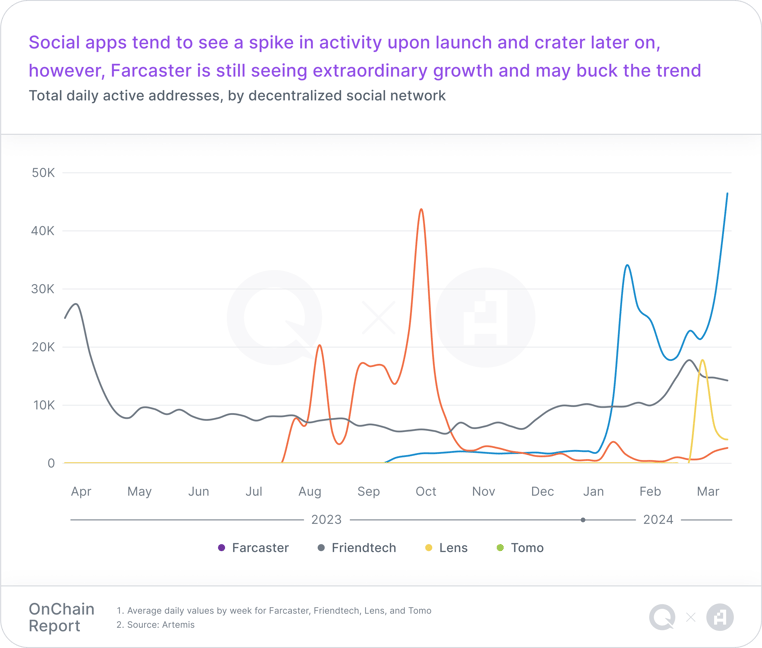

- Decentralized social networks experienced rapid growth during Q1’24 with a 425% increase in user activity, signaling a burgeoning interest in blockchain-based social platforms.

- Key platforms like Farcaster, Lens, friend.tech, and Tomo are leading the charge in the decentralized social space, each contributing to the evolving landscape of social interactions on the blockchain.

- Historically, decentralized social networks have seen a surge of initial user engagement that’s followed by a sharp decline as their ‘exclusive and new’ novelty fades. However, gradually increasing levels of active users post-spike suggest more stable user engagement over time, a potential sign of increased adoption.

Highlights: Social DApps

Farcaster and Lens were standouts in Q1’24, with Lens opening up to general availability and Farcaster still experiencing a run-up, showcasing an increased demand for decentralized social.Farcaster

- Farcaster is an infrastructure protocol that allows developers to build SocialFi applications that can interact with each other, such as Warpcast, an app likened to ‘onchain Twitter.’

- Daily Active Users (DAUs) on Farcaster exploded by 1,842% in Q1’24 with the introduction of Frames, which allows users to turn posts into interactive applications.

- With Frames, users can offer an NFT to another user if they follow their account and repost their Frame. The excitement of obtaining free NFTs, a potential airdrop, and support from Base have brought in a flood of users.

Lens Protocol

- Lens transitioned to a permissionless phase on February 27, meaning anyone can now create a Lens profile without needing an invite, opening up the decentralized social network to a broader audience and bringing Lens to par with Farcaster, which rolled out permissionless access in Q4’23 and has seen massive growth since.

- Inspired by the growth of $DEGEN and other memecoins on Farcaster, the Lens community has started introducing tokens to enhance ecosystem engagement, with $Bonsai emerging as a key memecoin within the Lens ecosystem.

Non-Fungible Token (NFT) Marketplaces

NFT marketplaces are online platforms where digital assets known as Non-Fungible Tokens (NFTs), which represent ownership of unique items or content on the blockchain, can be created, bought, sold, and traded.

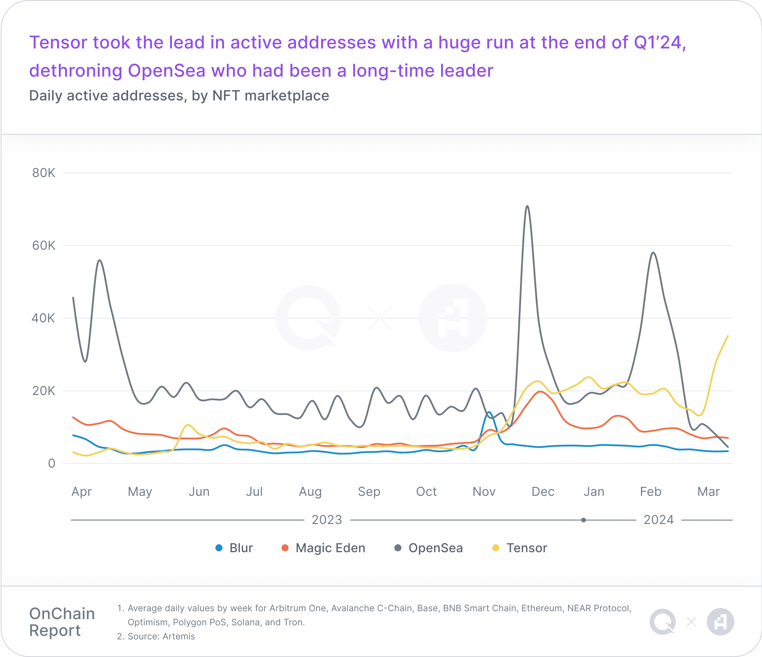

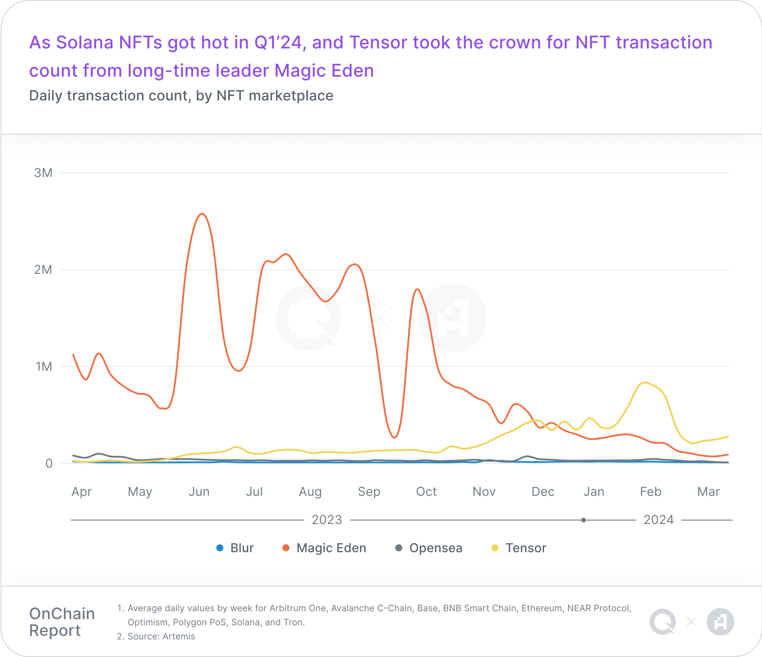

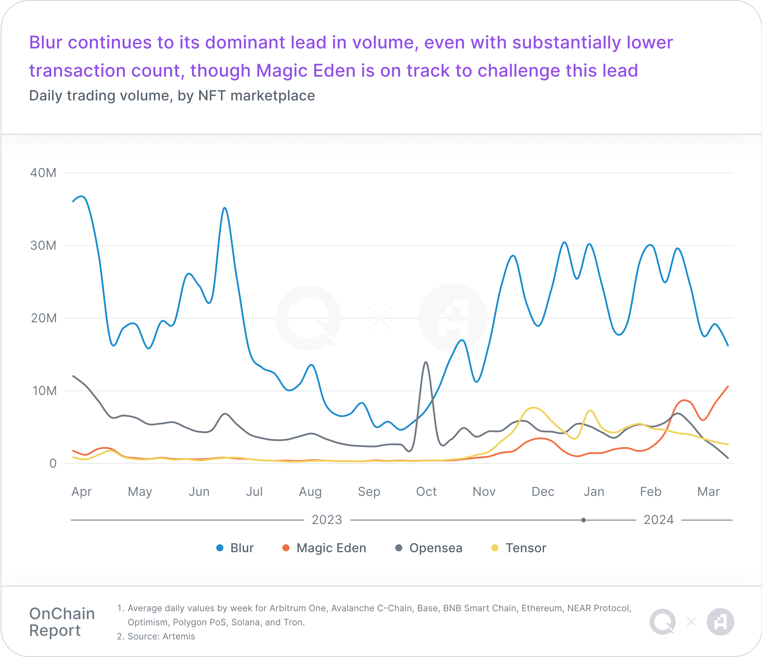

Key takeaways: NFT Marketplaces

- In 2023, Ethereum dominated all other chains for NFT marketplace volume, but in Q1’24, Solana NFT marketplaces skyrocketed in volume and activity. This was signified by Opensea being overtaken by Tensor in active address activity.

- While OpenSea and Magic Eden have historically dominated daily NFT active addresses and NFT transaction counts, respectively, the trend shifted in Q1’24 as Tensor took the lead in both areas, indicating a dynamic change in user preferences and platform performance.

- Since their introduction in January 2023, Bitcoin ordinals have not only captivated the market but also proven to be highly lucrative, generating hundreds of millions in network fees for Bitcoin miners leading up to the Bitcoin halving in April 2024.

Highlights: NFT Marketplaces

The NFT market showed significant transformation in Q1’24, fueled by growth in new areas such as gaming, on new chains like Solana, and in new applications like Bitcoin ordinals. This suggests that NFTs could be back with a vengeance in 2024.

Bitcoin Ordinals

- Ordinals allow data to be embedded into Bitcoin’s blockchain, enabling NFTs on Bitcoin. That’s interesting because it means ordinals live solely on the Bitcoin blockchain, making them very secure, unlike other NFT collections that host their metadata on centralized servers, which creates points of vulnerability.

- Since launching in January 2023, ordinals have generated hundreds of millions in network fees for Bitcoin miners. This has opened up totally new avenues for Bitcoin value generation and introduced new concepts like BTCFi, or Bitcoin decentralized finance, which aims to bring DeFi capabilities to the Bitcoin network.

Tensor

- On March 12, Tensor, the NFT marketplace supported by Solana's founders, announced the upcoming launch of their governance token, $TNSR.

- The announcement highlighted that Tensor protocols have traded over $2B worth of Solana NFTs and that, in the last 90 days, they have facilitated over 70% of Solana’s NFT trading volume.

- $TNSR began trading on April 8.

Enjoying the report?

Sign up for email updates on the evolving Web3 landscape.

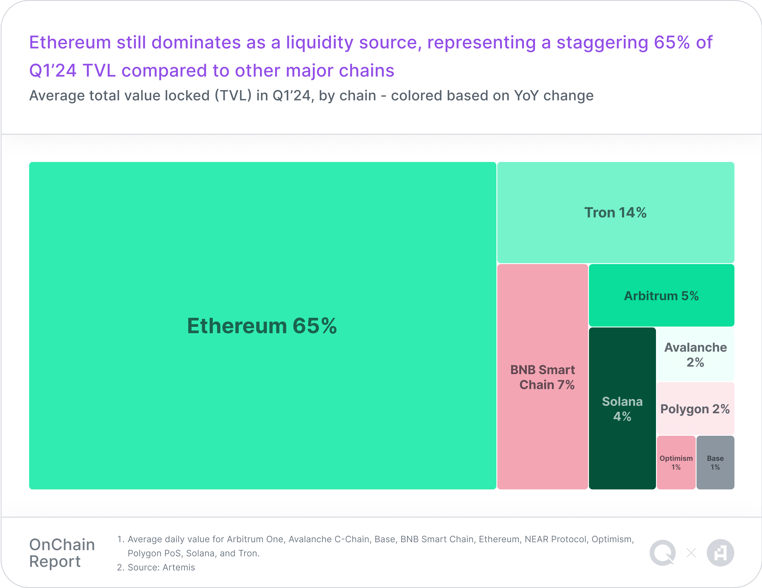

What are the most exciting chain developments today?

Layer 2 and Sidechains

Layer 2 solutions have significantly advanced blockchain scalability in Q1’24 with faster transaction speeds and reduced costs, helping to address key challenges like congestion and high transaction fees on primary networks.

The adoption of L2 platforms has shown rapid growth in Q1’24, demonstrating their potential to reshape the future of blockchain applications and the web3 community ethos in exciting new ways.

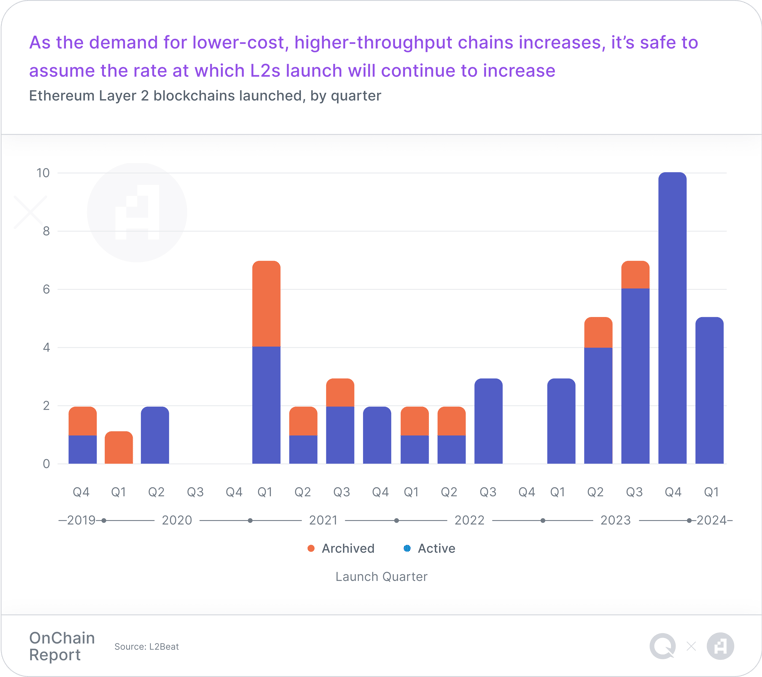

We continue to see the Layer 2 landscape expand with more chains launching each quarter.

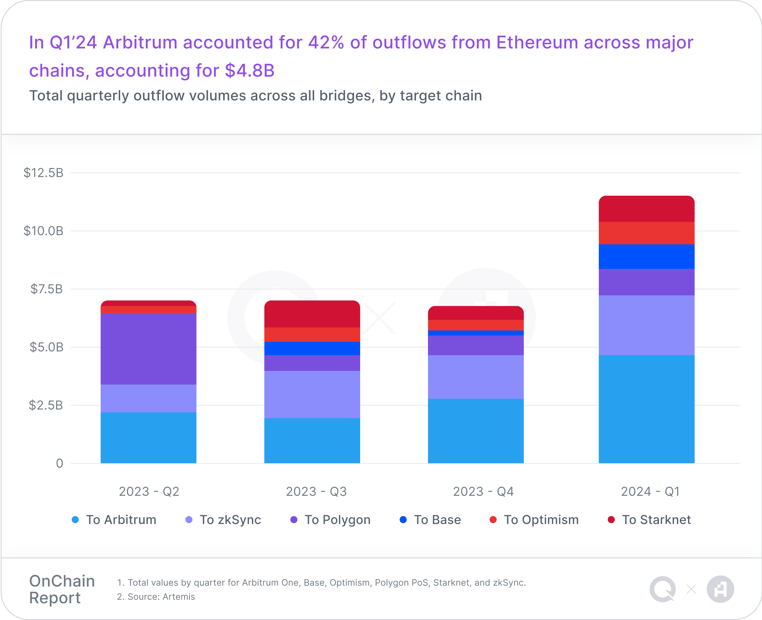

Arbitrum

Representing 44% of the TVL across all Ethereum Layer 2s, Arbitrum has long been a leader in the L2 race despite significant competition. In Q1’24, Arbitrum underwent two major events within days of each other.

The first event, on March 13, was a long-awaited Ethereum network update, known as "Dencun," that slashed L2 transaction fees by as much as 98%. Using Artemis to look at Arbitrum data from the week before and after the Dencun update, we can see average Daily Transactions nearly doubled with an increase of 96.2%, average Transaction Fees decreased dramatically by 93.5% (i.e., average Arbitrum transaction fees went from ~$0.30 to $0.01 virtually overnight), and surprisingly the Revenue only decreased by 62.6%. Put simply, Ethereum’s update allows Arbitrum to be even more accommodating of mass-market applications and adoption.

The second event, on March 16, was Arbitrum's long-anticipated massive token unlock. This event immediately unlocked 1.1B ARB tokens worth $2.32B and nearly doubled the circulating supply of ARB tokens. Following the unlock, there was an immediate sell-off of the new ARB tokens, but Arbitrum’s TVL remained mostly unchanged while daily active addresses and transactions surged.

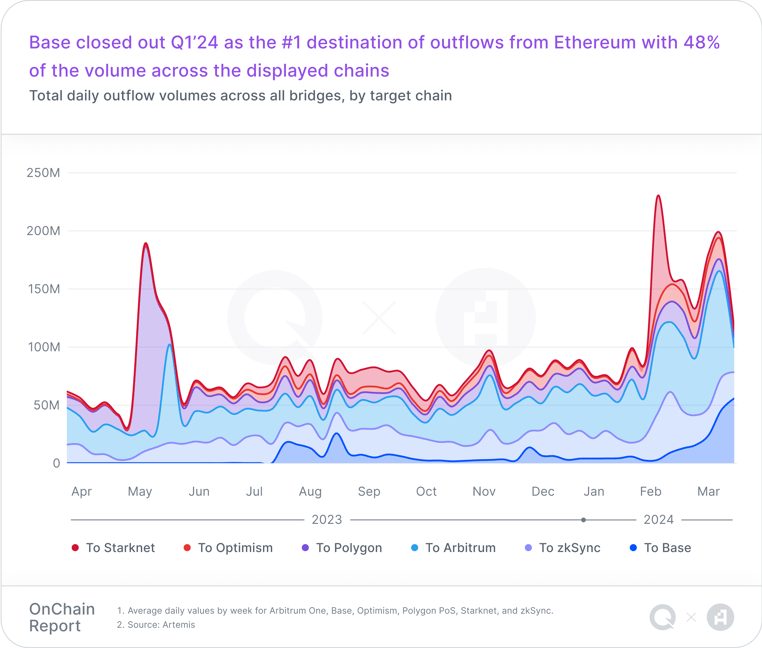

Base

Base, Coinbase's new L2 network, reached a significant milestone in Q1’24 by exceeding $1B in TVL. This further solidified its position as a key contender in an increasingly competitive space.

Base was a significant beneficiary of Ethereum’s March 13 network update, known as "Dencun," which slashed transaction fees on Base by ~93%. Following the update, March saw the highest daily DEX trading volume ever on Base, soaring by 487% and exceeding $1 billion per day for the first time.

While Uniswap was by far the largest source of DEX volume on Base in Q1’24, disruptive new decentralized exchanges have found a home on Base. In particular, Aerodrome had a breakout quarter, quickly garnering attention and becoming the #2 DEX on Base in both volume and TVL.

Base has also seen tremendous growth in areas such as decentralized social applications, e.g., Farcaster had a lot of success in Q1’24 as Base users became the majority share, as well as memecoins, which are gradually being seen by large ecosystems as a legitimate way to attract new users and community attention.

Optimism

In Q1’24, the Optimism network marked its territory as a formidable force in the Layer 2 ecosystem, leveraging its innovative OP stack to support several notable L2 launches. Base stands out as a prime example of the impact of Optimism's technology, alongside other chains like Blast and Mantle, which are also making significant strides under the OP stack umbrella.

Despite Arbitrum definitively leading TVL numbers at first glance, a closer look that considers tech stacks reveals a much closer race between OP stack-based solutions and Arbitrum. According to L2Beat, both were nearing a TVL of $19B at the end of the quarter. This becomes especially relevant as cross-stack communication tools like Optimism's Superchain continue to develop, underscoring Optimism’s role not only as a leader in L2 launches but also as a pioneer in fostering a more interconnected and robust blockchain ecosystem as we progress through 2024.

Polygon

In Q1’24, Polygon made significant advancements in its technology stack as part of the ambitious Polygon 2.0 roadmap, which is all about infinitely scaling Ethereum’s network through a collection of zero-knowledge (ZK) chains with unified liquidity that powers a seamless user experience and mass adoption.

In particular, Polygon released AggLayer v1 Mainnet on February 23, which introduced the aggregation layer, or AggLayer. This cross-stack communication tool aims to unite a divided blockchain landscape into a web of ZK-secured L1 and L2 chains that feel like a single chain. Additionally, Polygon is progressing on transitioning from a sidechain to a L2 network using its Chain Development Kit’s (CDK) validium configuration.

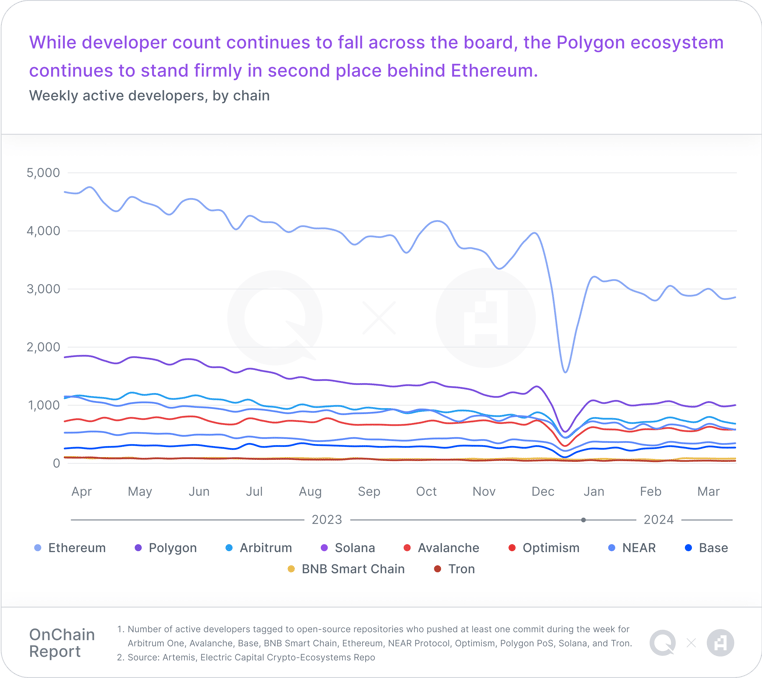

Polygon's developer ecosystem continues to show strength, behind only that of Ethereum itself. While active developers continue to fall across the board, Polygon retains its second-place position.

Layer 1

In Q1’24, Layer 1 blockchains are at the forefront of some of the most transformative developments in the web3 landscape as they increasingly focus on improving interoperability and user experience. Major Layer 1 networks like Ethereum and Solana are now prioritizing native functionalities that aim to solve the persistent blockchain trilemma: balancing security, scalability, and decentralization.

As Layer 1 blockchains continue to evolve, the focus on developing these interoperable solutions is critical, promising a future where blockchain can finally operate with the fluidity and scalability once envisioned.

Ethereum

Ethereum has long been the largest blockchain developer platform with the most established application ecosystem, but it has also been significantly more expensive to use versus alternatives, with average transaction fees of $2.30 in February 2024. This has severely limited the mass market adoption potential for applications building on Ethereum as gas fees quickly became prohibitive once any uptick in network usage occurred.

The introduction of EIP-4844 in March 2023 marks a pivotal change in Ethereum's transaction fee landscape. It significantly reduces costs associated with L2 transactions, potentially ushering in a new era of widespread adoption for decentralized applications.

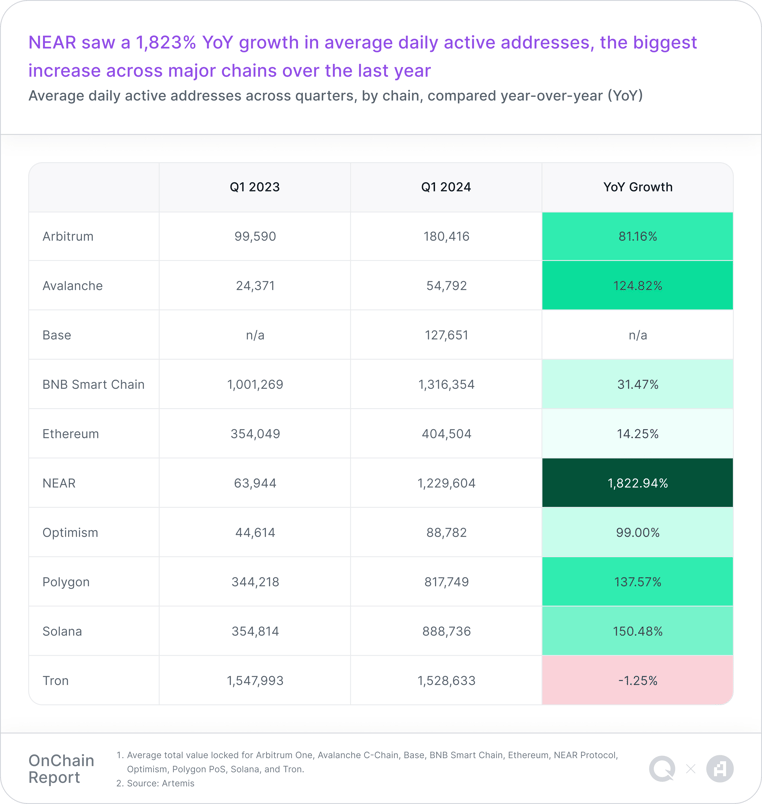

NEAR

NEAR protocol unveiled an ambitious updated roadmap in early Q1’24, which laid out its plans to expand its position as a leading platform for decentralized applications (dApps). Among the major chains, NEAR is one of the fastest expanding, showing tremendous QoQ and YoY growth. This comes from initiatives such as its cross-chain bridge, major partnerships, and explosive user growth from projects such as KAIKAINOW, Sweat Economy, Aurora, and Playember.

Solana

Solana had a spectacular start to the new year with exciting growth in multiple categories and standout success in key ecosystem metrics, proving it is one of the hottest chains in web3 right now.

In Q1’24, the Solana ecosystem highlighted active developers building on the chain continue to grow and stay there. Additionally, the foundation launched Token extensions, enabling a suite of configurable features that stablecoin issuers, such as GMO Trust and Paxos, have adopted.

One of the primary motivators of Solana’s Q1’24 growth is that it has quickly become a home for a growing number of retail users, DeFi innovators, NFT creators, airdrop opportunists, and memecoin traders. This influx of new address activity has resulted in Solana’s average daily DEX volume increasing by 180% QoQ to $1.2B.

Subsequently, Solana’s revenue, which measures USD value accrued to the protocol and its token holders, has skyrocketed by a remarkable 597% QoQ, going from $7.1M in Q4’23 to $49.5M in Q1’24. Solana's stablecoin market capitalization has also increased 49.4% QoQ from $1.9B to $2.9B, making it the fifth-largest stablecoin supply source among all chains.

Enjoying the report?

Sign up for email updates on the evolving Web3 landscape.

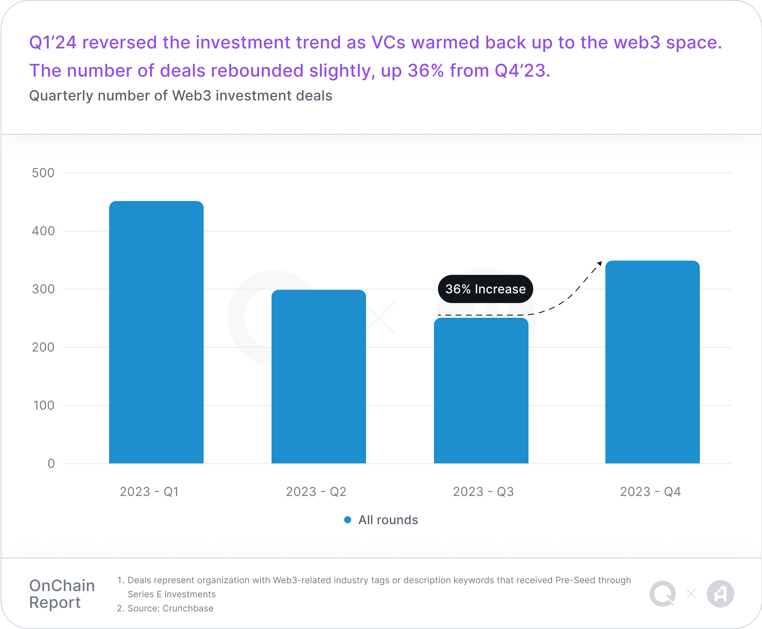

What are VCs betting on for the long term?

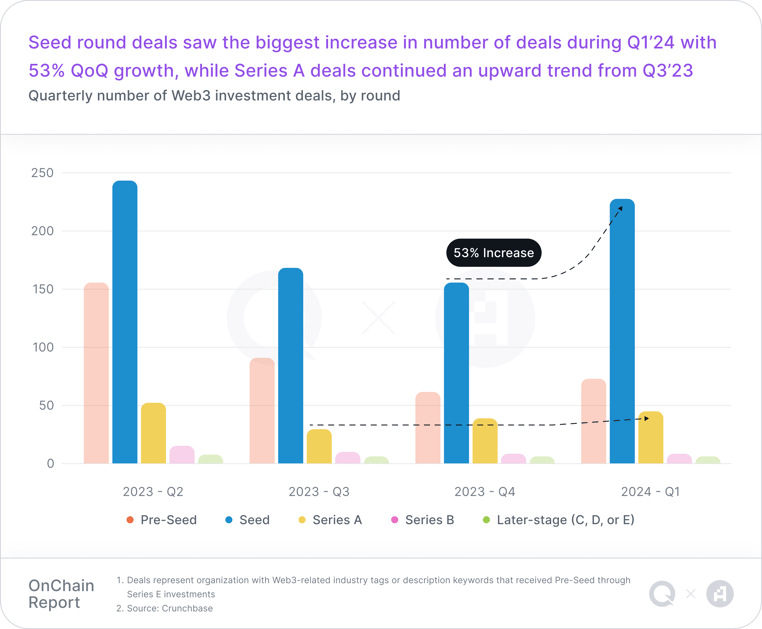

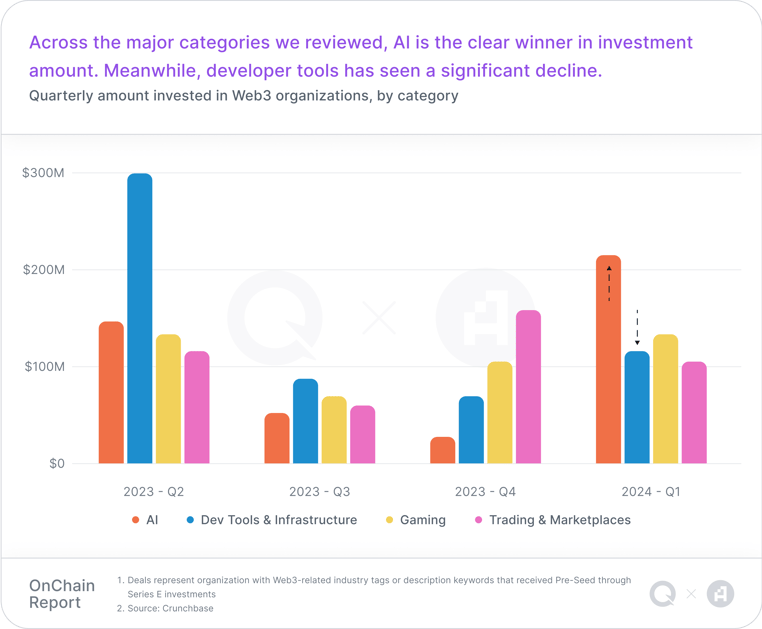

One of the most important data points this quarter was a 36% growth in the number of web3 deals, indicating that investments are increasing for the first time in over a year, and suggesting a favorable shift in VC sentiment for web3. In particular, AI and Gaming have garnered the most resounding revival of venture capital enthusiasm among the categories.

Follow the money, a review of Q1'24 investments

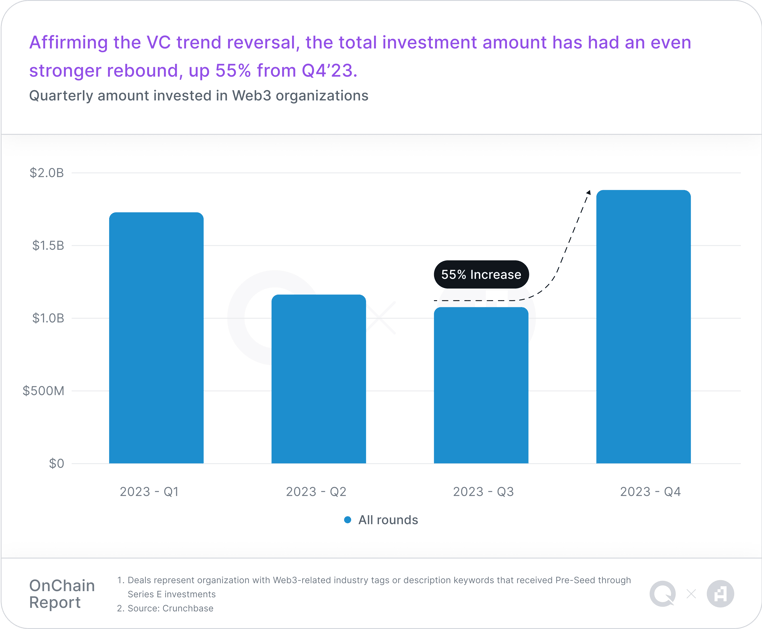

In addition to a 36% QoQ growth in the number of deals, the total investment in web3 increased by 55% compared to Q4’23, indicating a strong rebound in VC confidence and investment activity.

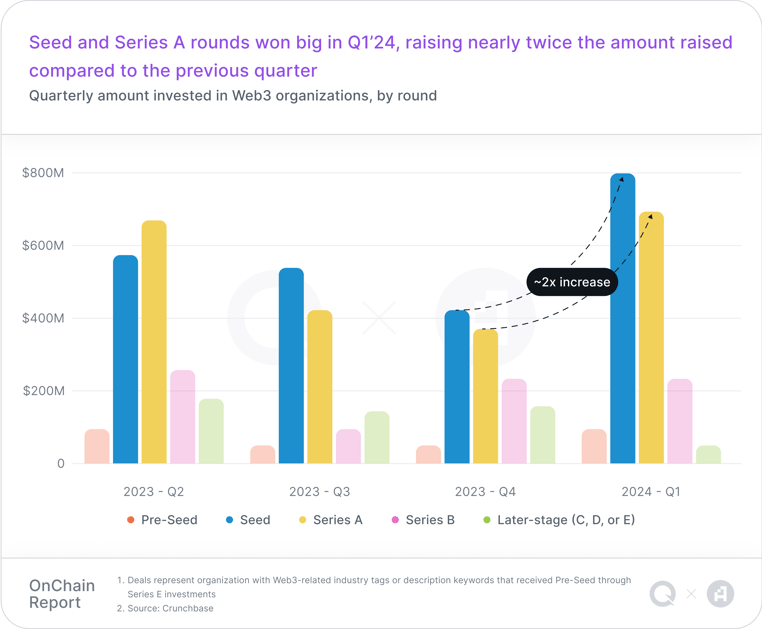

Seed round deals experienced the most substantial growth, with a 53% QoQ increase, signaling a heightened interest in early-stage ventures. Series A and Seed funding rounds significantly increased their capital inflow, nearly doubling the amounts raised in the previous quarter, reflecting VCs' renewed willingness to invest in web3.

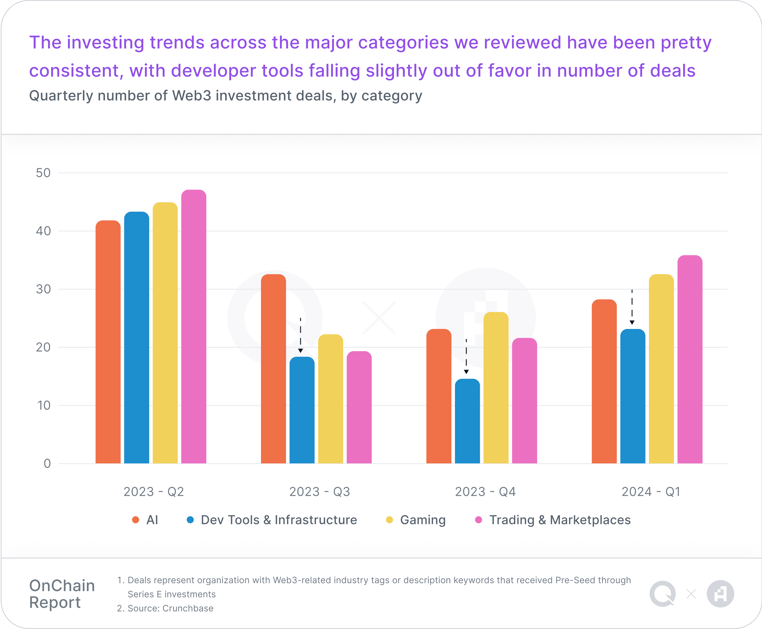

Among the categories, AI stood out as the clear favorite, drawing substantial investment and interest in exploring how AI can become a key value driver within web3. Examples of this in Q1’24 include 0G Labs launching a $35M pre-seed to build a modular AI blockchain. In contrast, sectors like developer tools and trading experienced only marginal increases in funding and deal counts, indicating a more cautious approach from investors, possibly due to uncertainties or less immediate returns in these areas.

Overall, the first quarter of 2024 not only restored growth trajectories in venture capital funding for web3 but also highlighted strategic shifts toward sectors that VCs believe will deliver substantial impact and drive the evolution of the blockchain landscape. This period has set a precedent for energetic and strategic engagements in web3, reinforcing the belief in its significant role in the broader technological ecosystem.

VC Sentiments for the Future

VC sentiment highlights a burgeoning era of consumer social experimentation fueled by crypto advancements and efficient transactions. Key focus areas include innovative solutions, strategic market approaches, sustainable financial practices, and ensuring future growth through diversified leadership and equipping them with appropriate tools and ethos.

We spoke with top firms in the space to get their view on the future:

It's my theory that AI and blockchain are about to collide and reinforce each other. Imagine a world where you cannot trust a single JPG, audio recording, or video. Now, imagine if the device you use to capture this content could also inscribe and verify its origin on an immutable global ledger. Suddenly, you have a great case for the blockchain that isn't speculative or particularly flashy – it's utility.

Venture capital interest in blockchain indeed has surged in the last six months, coinciding with the recovery of Bitcoin prices. Several key trends have emerged this year beyond AI and Gaming, including Bitcoin L2, ZK, meme coins, RWAs onchain, socialfi, restaking, chain abstraction, and others.

At Alliance DAO, we are thrilled to see our alumni close funding in Q1 much faster than a year ago. A growing number of them receive term sheets even before the Demo Day. Given that venture investment tends to lag public markets by a couple of quarters, we expect another uptick in funding in Q2. Alliance DAO is committed to supporting ambitious founders at the earliest stage.

AI's integration into the web3 landscape isn't just a trend, it's a seismic shift reshaping the industry. As a VC, we're not just witnessing growth; we're actively investing in the founders who have a vision for creating agile infrastructure that can keep pace with AI/ML's evolution in the decentralized space.

Good technology is only effective when it can be easily used at scale. Blockchains have been slow and expensive in the past, but we are incredibly excited to see major advancements in the space, with teams like EigenLayer hyperscaling Ethereum, Ritual bringing AI on-chain, and Argus building the world engine for on-chain gaming. Wagmi Ventures is fortunate to be part of their early journeys, and to witness them spur the industry into a new era.

WAGMI Ventures’ mission is to accelerate mass adoption by investing in the most talented and determined founders seeking to scale blockchain technology and adoption, whether it be by lowering the learning curve for new users, enhancing the security of the space, or building the most engaging consumer dapps.

Wrap-up

In Q1’24, blockchain activity showcased a vibrant and expanding ecosystem, setting new benchmarks for innovation and user adoption. This surge underscores a promising trajectory for the decentralized future, with web3 technologies playing a major role.

About QuickNode

Since its founding in 2017, QuickNode has emerged as the go-to solution for businesses and innovators requiring world-class blockchain development tools for speed, reliability, and security. Handling over eight billion blockchain requests daily, QuickNode boasts a 2.5X faster response time than competitors and 99.99% uptime across 30+ chains and 35+ networks. With a user-friendly interface and a robust multi-chain developer tool suite, QuickNode is an ideal choice for top web3 businesses and global brands.

About Artemis

Since launching in 2022, Artemis has emerged as a premier institutional data platform for digital assets. Delivering insights across 25+ blockchains, Artemis stands out as the definitive data science layer for crypto fundamental information. From sector-specific metrics to real-time developer engagement insights, Artemis ensures that users are equipped with the most comprehensive and customizable digital asset data available. With its wide availability of data ingestion choices, from Excel integrations to Snowflake Data Shares, Artemis is the data platform of choice for global financial institutions and investors.

Our methodology

This report employed a defined methodology to gather data, focusing on several notable chains: Arbitrum One, Avalanche C-Chain, Base, BNB Smart Chain, Ethereum, NEAR Protocol, Optimism, Polygon PoS, Solana, and Tron. The metric examined was the average daily value, analyzed on a weekly basis, with Artemis.xyz serving as the primary data source. This approach enabled a meticulous exploration of the weekly trends across the selected chains, forming the basis of our analysis.

Did you enjoy the report?

Sign up for email updates on the evolving Web3 landscape.

.png)