Overview

In a landscape marked by relentless innovation, the blockchain ecosystem has continued to evolve rapidly over the last quarter. This report, jointly presented by QuickNode, a leading Web3 infrastructure and developer platform, and Artemis, an institutional data platform for digital assets, provides an insightful perspective on the sweeping commercial advancements observed across different chains and industry sectors. This report provides a comprehensive overview of current blockchain activity by examining the following:

- Usage Today: Consumer trends that highlight the areas with the highest and fastest-growing usage today

- Medium Term: Emerging trends as seen by developer activity and new solutions being shipped

- Long-term: The investment landscape shows where venture capitalists (VCs) are placing long-term bets

By centering the narrative around blockchain developers and end users, we gain valuable insights into the roadmap for building a sustainable and rapidly expanding Web3 ecosystem. These insights, combined with the context of product launches and investments, give us a comprehensive story of where we're heading.

*Our methodology:

This report employed a defined methodology to gather data, focusing on several notable chains: Arbitrum One, Avalanche, Base, BNB Chain, Ethereum, OP Mainnet, and Polygon PoS. The metric examined was the average daily value, analyzed on a weekly basis, with Artemis.xyz serving as the primary data source. This approach enabled a meticulous exploration of the weekly trends across the selected chains, forming the basis of our analysis.

Key Takeaways

Standout narratives from Q3

Standout narratives from Q3

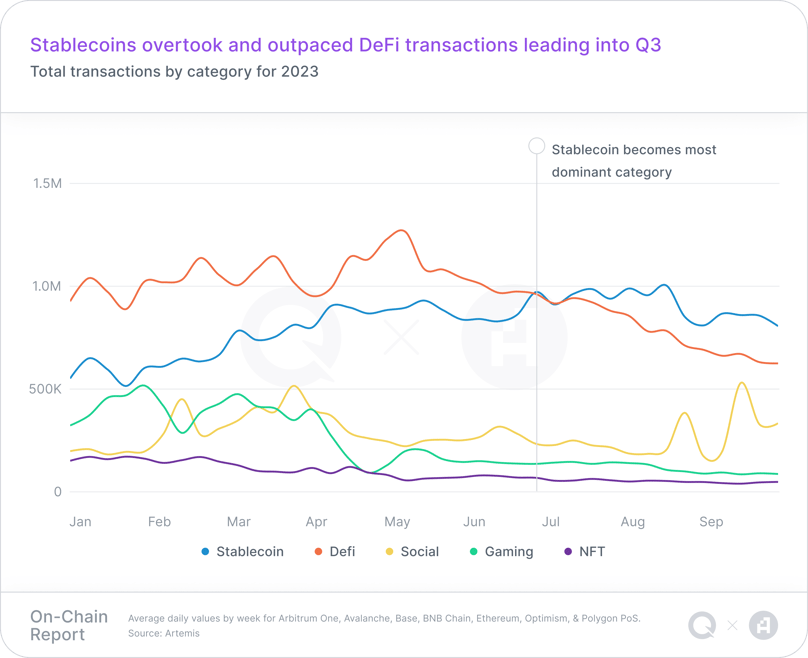

- Consumer activity was dominated by financial activity, with Stablecoin activity taking the crown from DeFi

- DeSocial is starting to emerge with viral product launches, making it an area we suggest keeping an eye on in the near term. The potential for a Web2 scale social app will turn our current levels of adoption on its head

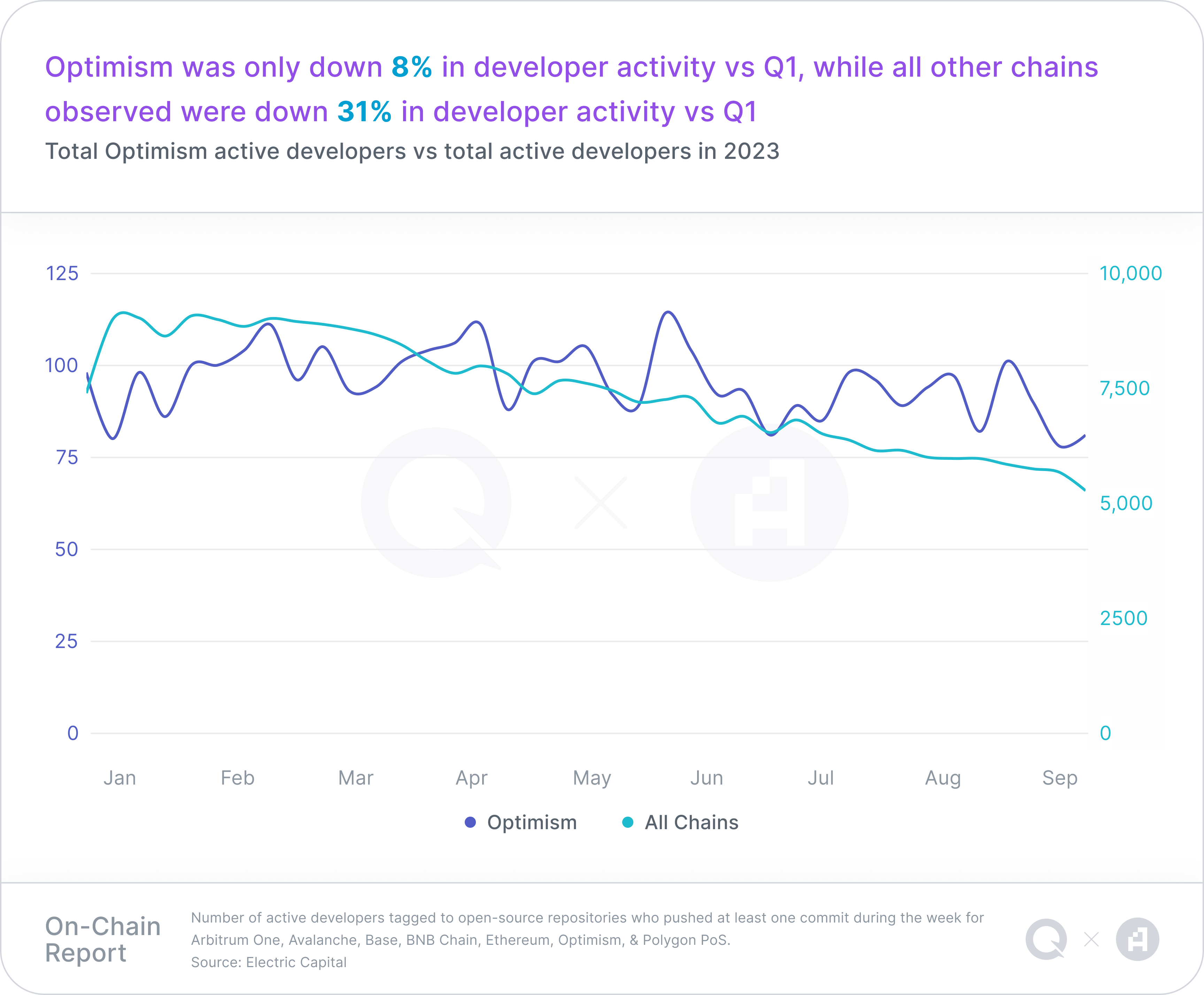

- Development activity remains strong only on Optimism’s OP Mainnet, suggesting that developers see EVM scaling solutions as a critical problem to solve in the near term

- Future trends, as informed by investment data, suggest that gaming and AI offerings are where we'll see greatest emergence in the coming years

Consumer Trends — Where are users today?

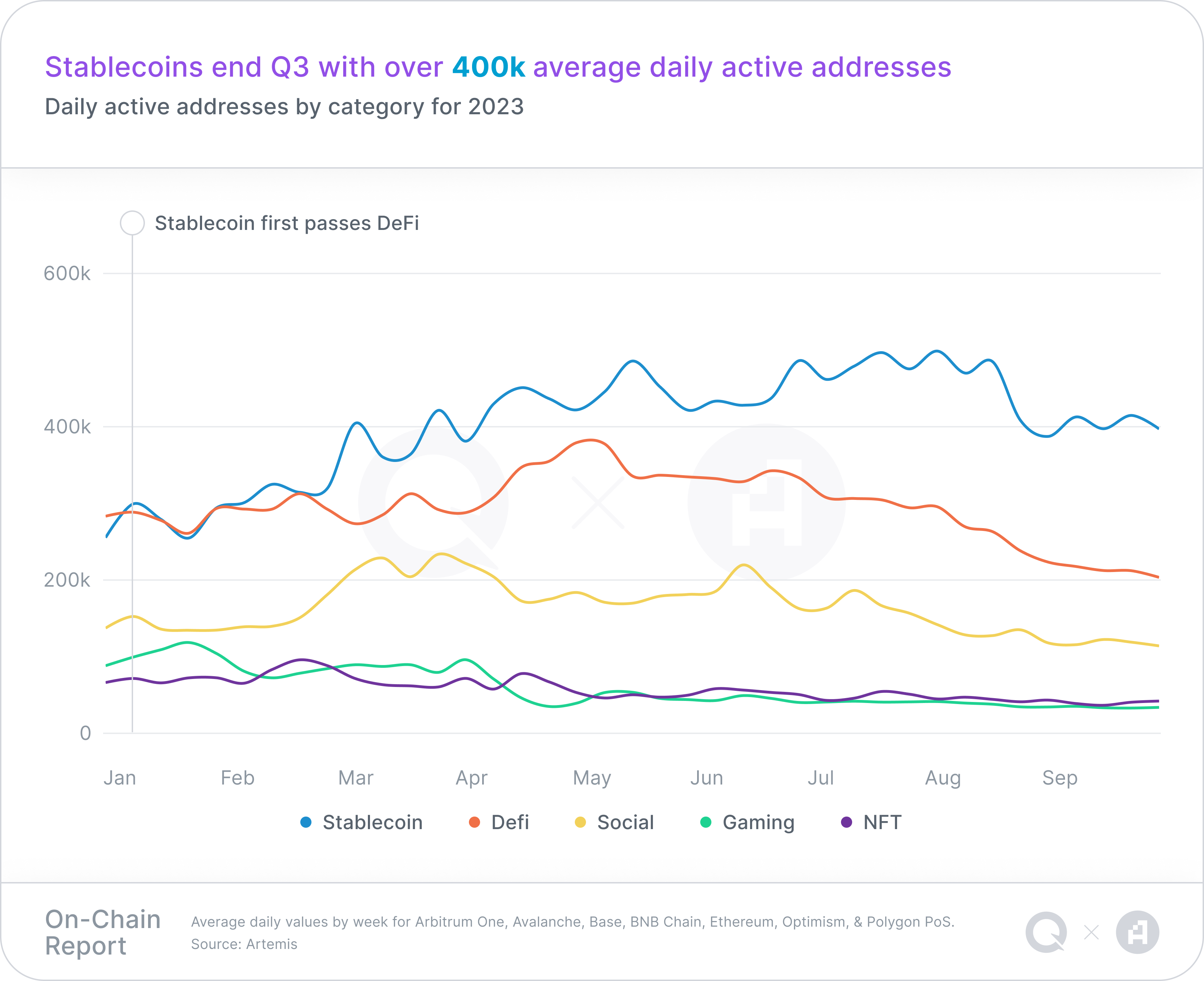

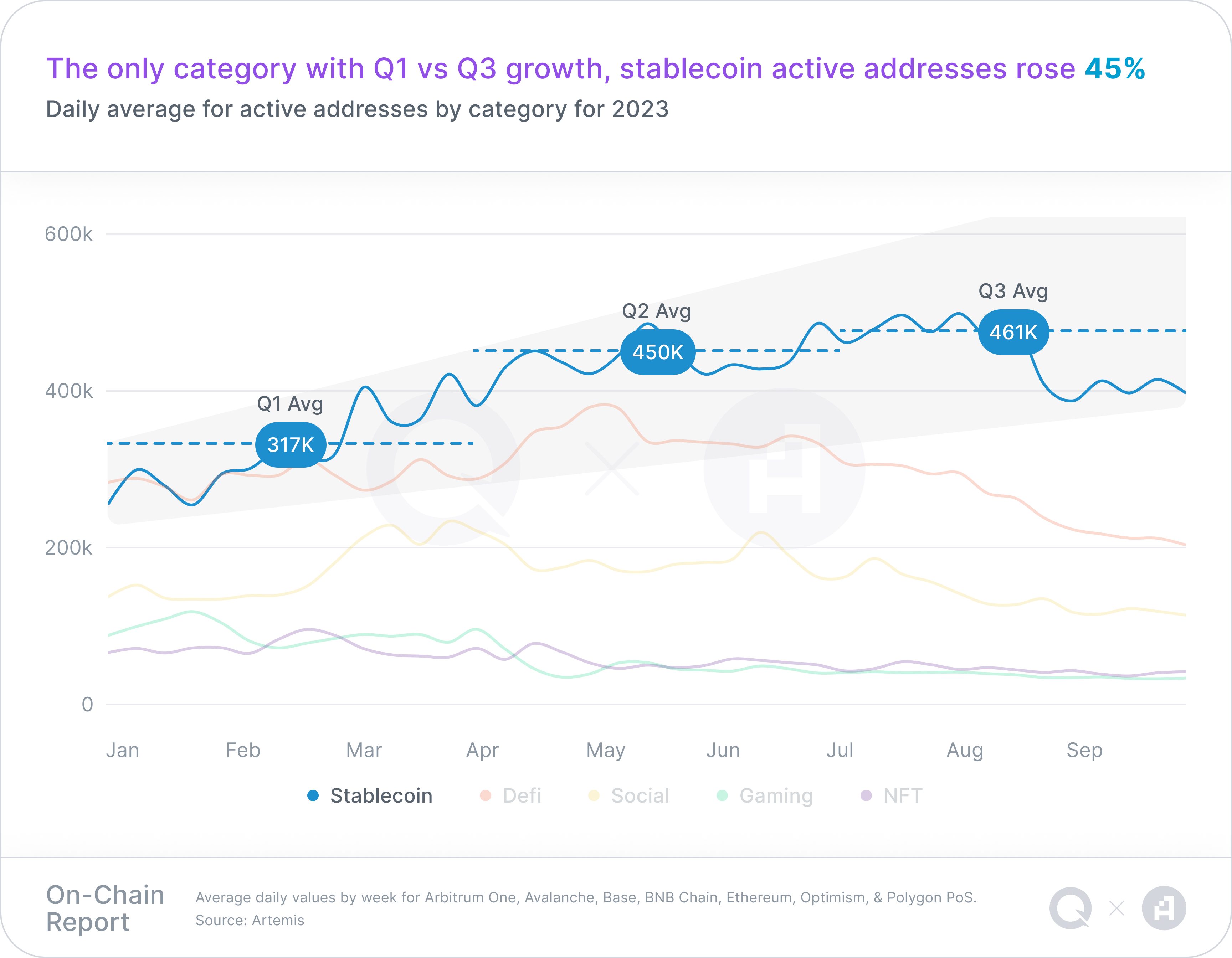

As we entered Q3 of 2023, the blockchain landscape continued to exhibit a mix of growth and challenges. The daily active addresses — a measure of usage — tell a story of ups and downs, reflecting the evolving nature of this technology. Amidst this, certain areas have stood out: Stablecoins, Decentralized Finance (DeFi), and Social. These categories, with their distinct appeal and robust product-market fit, have become the epicenters of user activity on a global scale.

Despite the diversification and expansion in use cases, financial applications and value transfer remain the dominant sectors, boasting the highest levels of user adoption. Over the last quarter, the narrative has continued evolving as Stablecoins have become the most popular category as measured by daily active addresses and the only category that has shown growth in Q3 2023.

Gaming

- While gaming has seen a significant decline on the chains we’ve covered, if you expand outward, it has shown strong staying power.

- Standout chains for gaming not covered in our data include WAX, Flow, NEAR, Solana, and Immutable X.

- Significantly down from all-time highs in 2021, Axie Infinity is still a top performer today by volume.

NFTs

- We’ve certainly seen a decline in the weekly PFP project launches and speculation from 2021, as seen in our data.

- Low-fee chains represent noteworthy usage and by some measures, is even up on the year.

- Standout chains for NFT activity not covered in our data include Solana, Mythos, Immutable X, and WAX.

Enjoying the report?

Sign up for email updates on the evolving Web3 landscape.

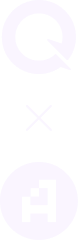

Stablecoins

Stablecoins are a type of cryptocurrency designed to minimize volatility by being pegged to a stable asset or a group of assets, often reserve-backed currencies like the US dollar or other commodities such as gold.

Key takeaways: Stablecoins

- Stablecoins are the dominant player in terms of daily active users across all categories.

- USDT outpaced other stablecoins regarding market cap, active addresses, and transactions.

- USDC still surpasses USDT in regards to volume in Q3; however, the gap has been significantly closed since Q1 — mainly following the collapse of Silicon Valley Bank and USDC de-pegging (about $0.03 off the peg).

We can also look at the increasing integration of blockchain solutions into traditional finance systems, driven by mega-cap payments companies like Visa and PayPal, suggesting that this trend will continue upwards. These corporations entering the space are not only an endorsement of the technology but also facilitate the bridge between the traditional finance world and decentralized finance.

Tron

- Tron ranks #2 in stablecoin market cap at $44b, closely trailing ETH's $66b and 7x larger than #3, BSC at $5b.

- USDT dominates Tron's stablecoin scene, making up 92% or $41b, marking Tron as the top ecosystem for USDT supply.

DAI

- MakerDAO's DAI is the leading decentralized stablecoin, created and burned through overcollateralized loans.

- DAI grew 23% in Q3, rising from $4.4b to $5.5b, following a temporary yield boost for staked DAI from 3.19% to 8%.

Decentralized Finance (DeFi)

A blockchain-based ecosystem enabling direct financial transactions and services, eliminating traditional intermediaries, and giving users full control of their assets.

Key takeaways: DeFi

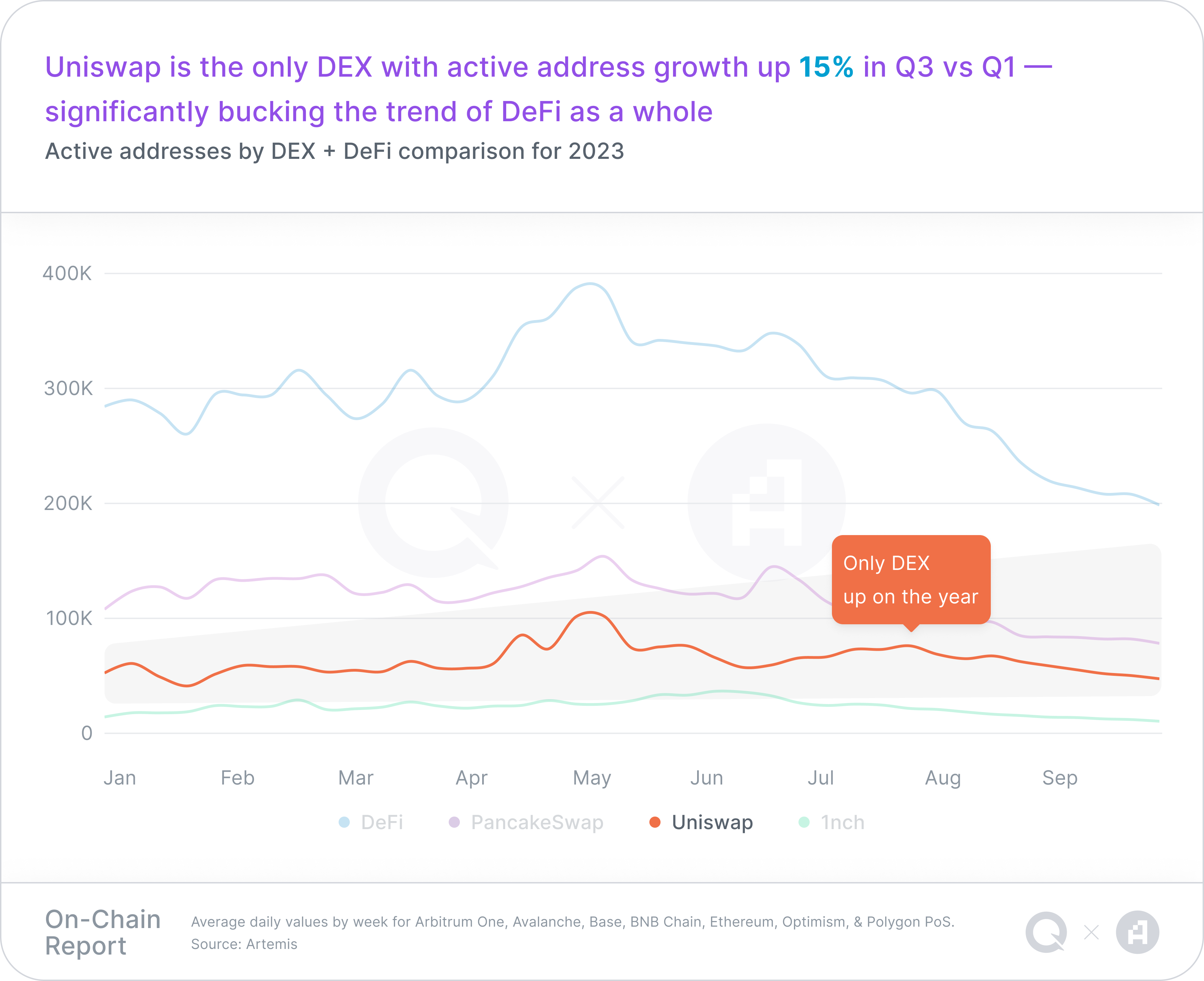

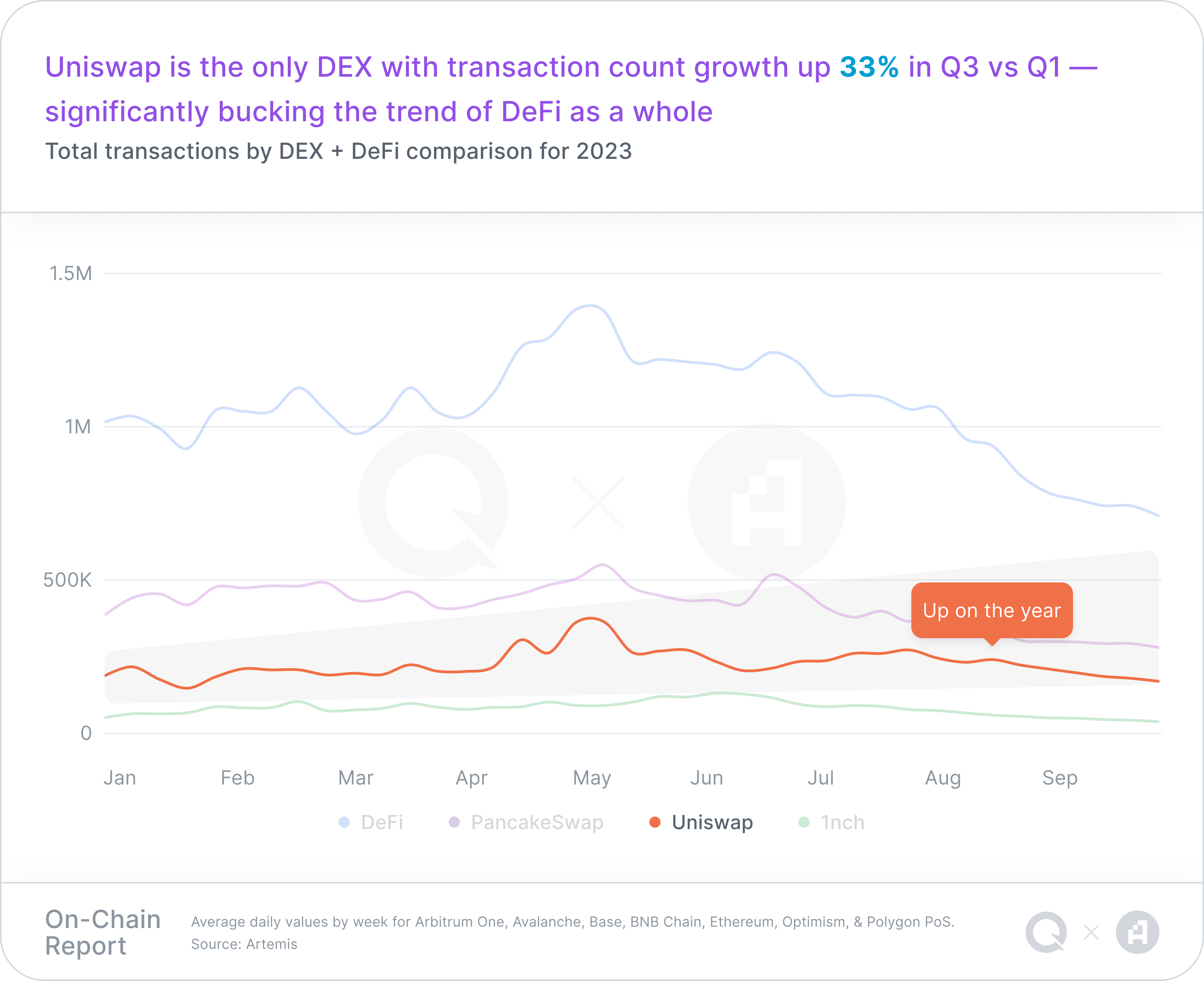

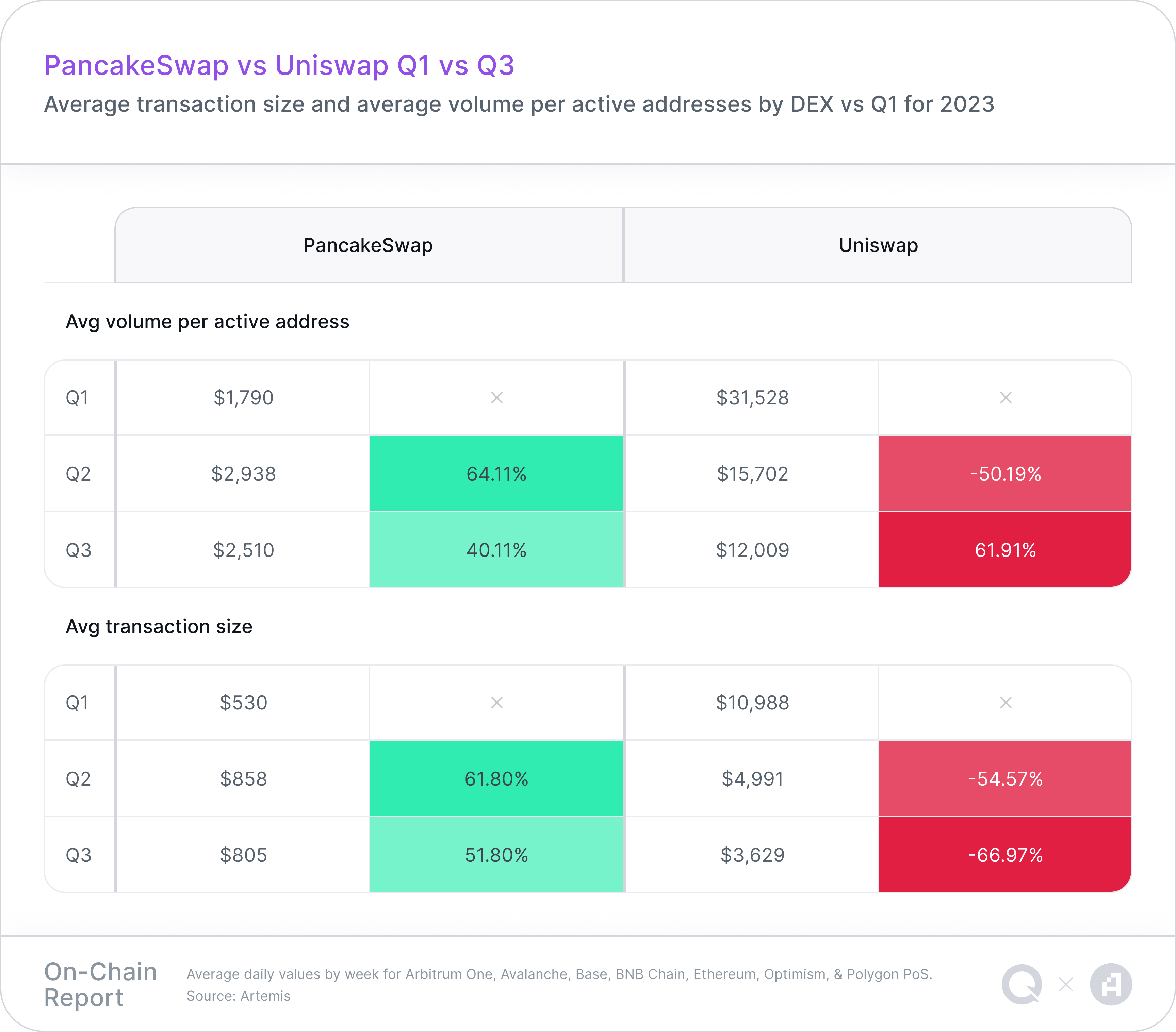

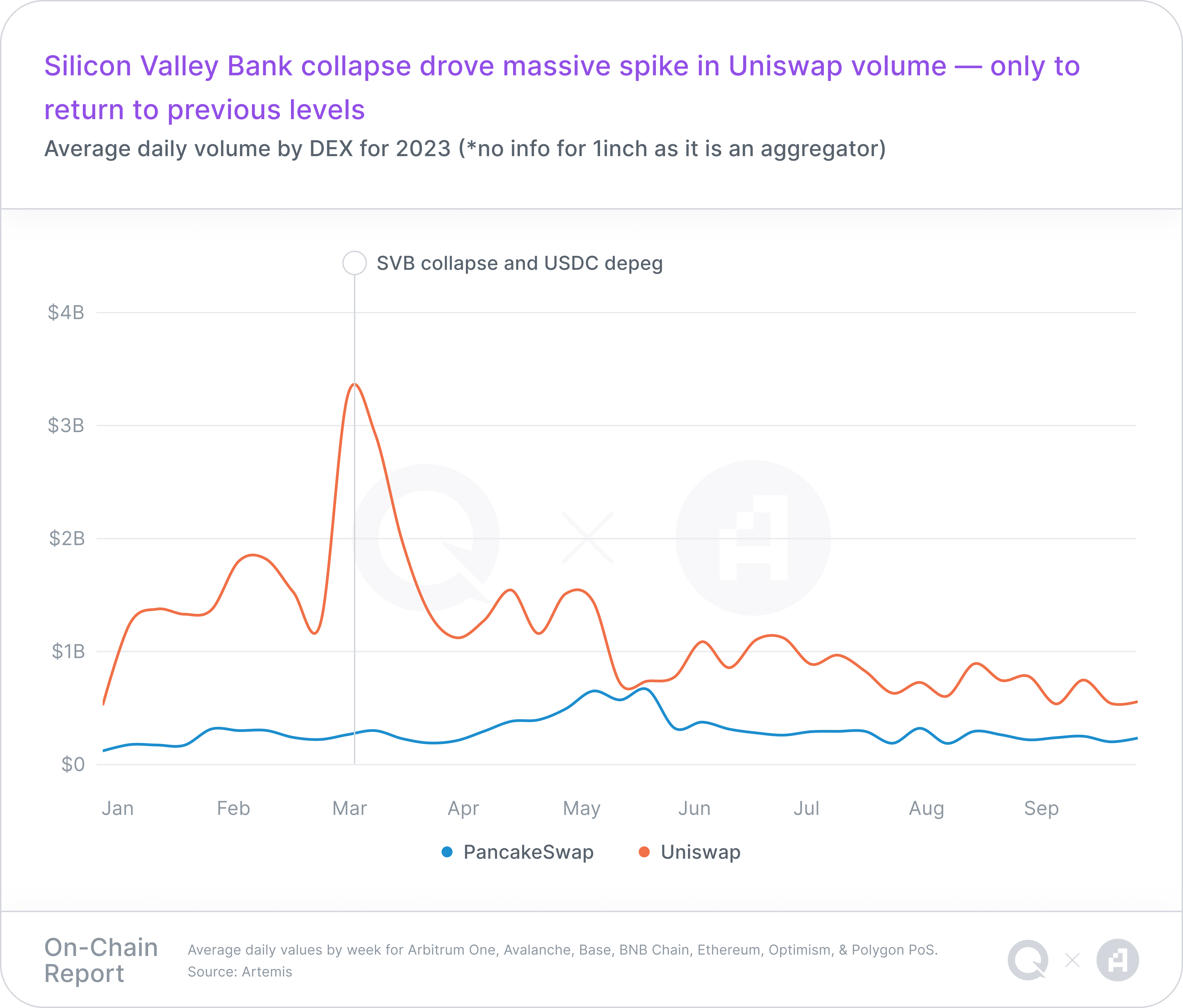

- Uniswap is the only DEX that has maintained stability without a massive downtrend since Q1 2023

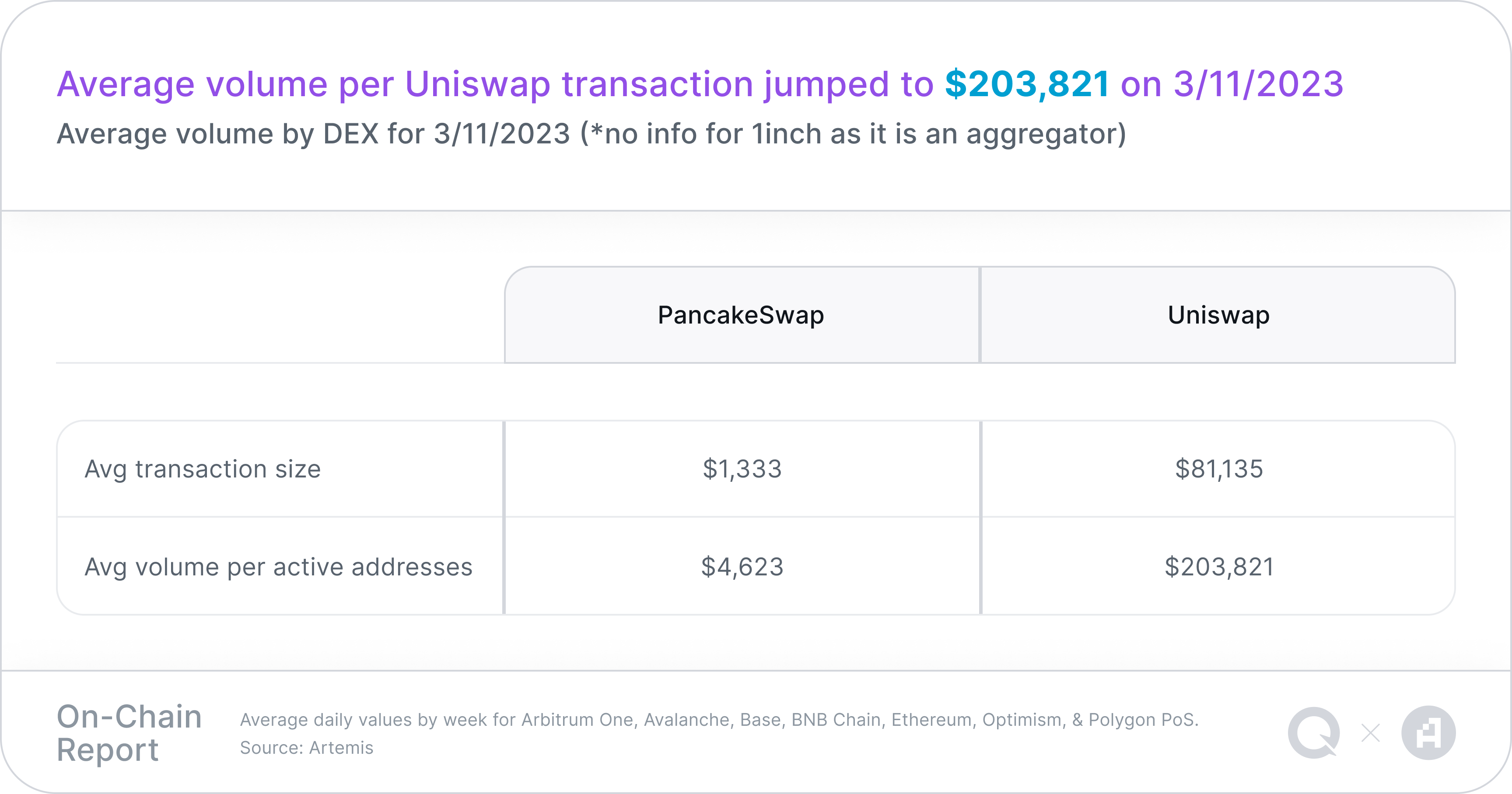

- When SVB collapsed, there was a massive spike in volume on Uniswap, but not regarding the number of transactions or active addresses, meaning there were a few huge transactions by volume around that time.

DEXs still account for the largest subcategory of DeFi, but staking continues to gain steam. The total amount of staked Ether grew aggressively in Q3 from 23.7M to 27.2M, with 37% attributed to Liquid Staking — an innovative offering akin to distributing IOU tokens for your staked assets.

Lido

- Users depositing Ether in Lido DAO's protocol get stETH tokens in exchange, allowing DeFi participation while earning ETH rewards.

- Lido held 32% of staked ETH by Q3's end, with its value growing 16% from $7.6b to $8.8b.

Figment

- Figment, prominent in staking, funded the development of the Liquid Collective protocol, now supported by contributors like Coinbase, Bitcoin Suisse, Hashnote and more.

- Liquid Collective saw incredible 956% Q3 growth, from 2.5k to 24.8k ETH staked.

Non-Fungible Token (NFT) Marketplaces

NFT marketplaces are online platforms where digital assets known as Non-Fungible Tokens (NFTs), which represent ownership of unique items or content on the blockchain, can be created, bought, sold, and traded.

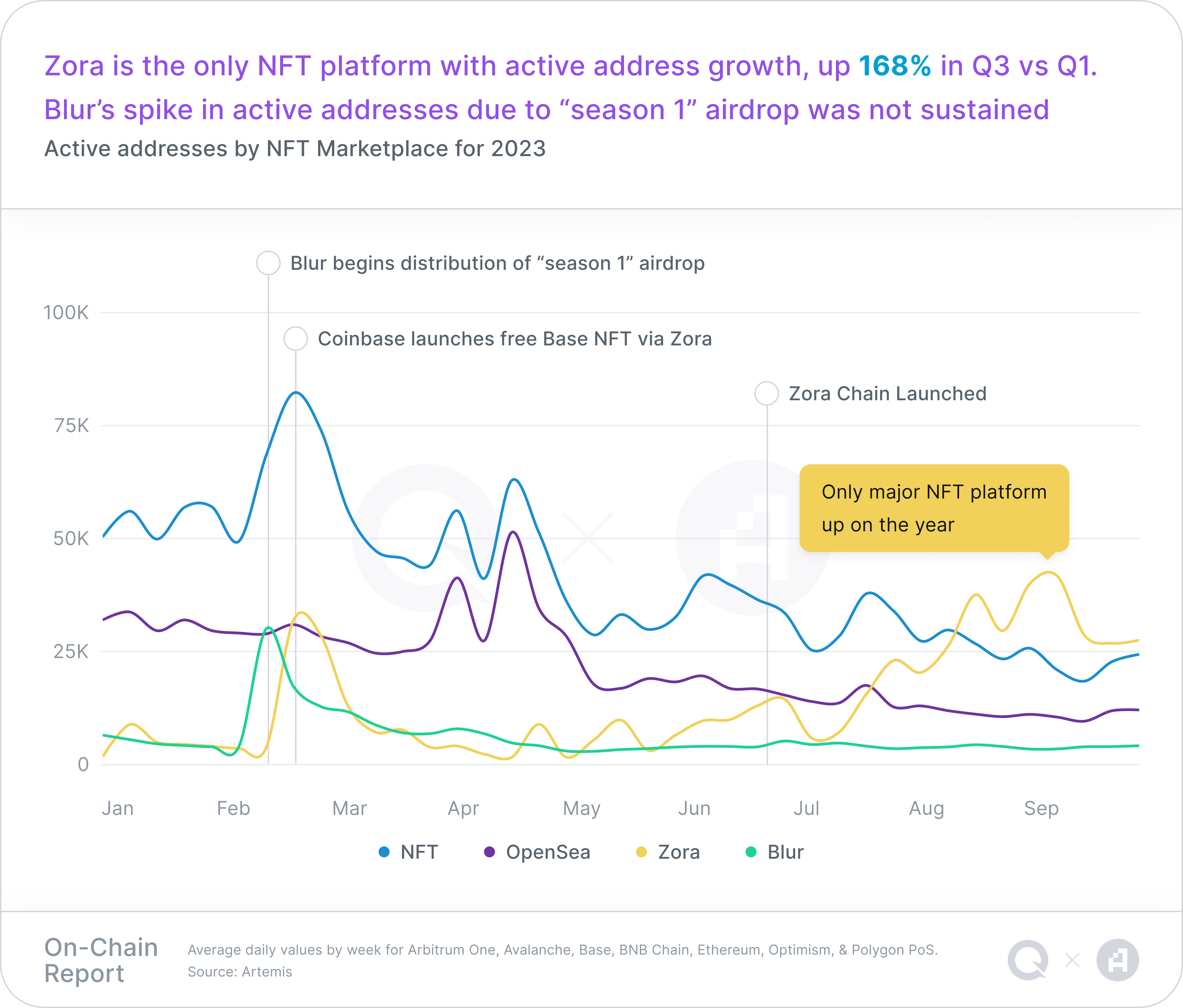

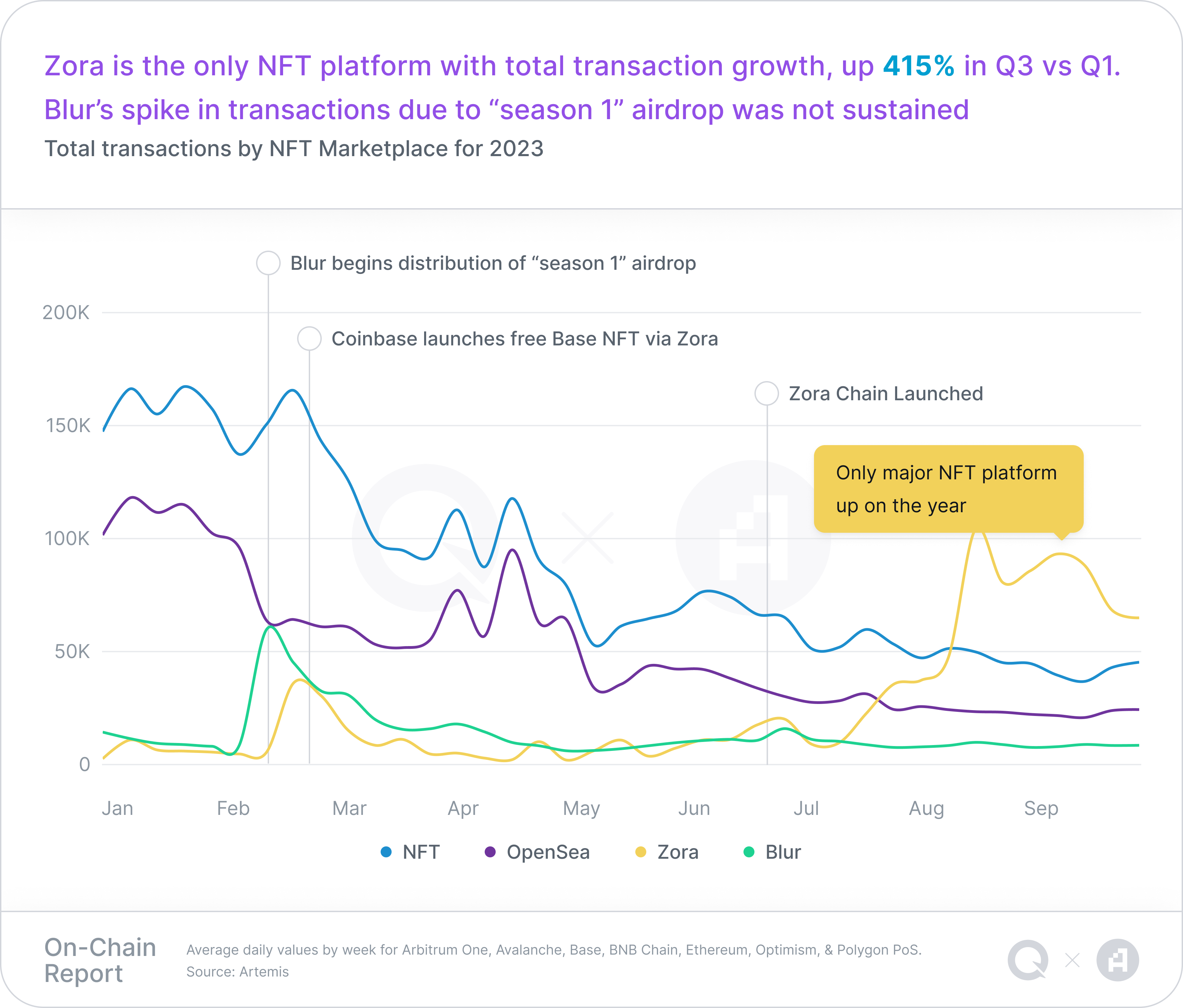

Key takeaways: NFT Marketplaces

- The NFT Marketplace category saw a spike in activity with Blur's first airdrop and Zora's free Base NFT drop in February 2023 — increase in volume has not been sustained

- Zora launched its Layer 2 chain, Zora Network, on June 21, 2023

Tensor

- Coming onto the scene last summer, Tensor's Solana-based NFT Marketplace has made strides in 2023.

- In May, a week of its trading volume surpassed Magic Eden, making it Solana's top marketplace.

- By Q3, Tensor consistently led with $1.6m in trading volumes, ahead of Magic Eden's $1.3m.

DRiP

- Leveraging Solana's Compressed NFT standard, DRiP Haus offers an affordable method to mint NFTs at Web2 scale — minting over 36M NFTs distributed to over 500K collectors.

- Compressed NFTs significantly reduce costs. Ex. 1M NFTs cost 4 SOL, as opposed to non-compressed which would be 1,200 SOL.

Decentralized Social

Decentralized social applications are peer-to-peer platforms that facilitate direct interactions and exchanges between users without intermediaries, using blockchain technology to ensure transparency, security, and data ownership.

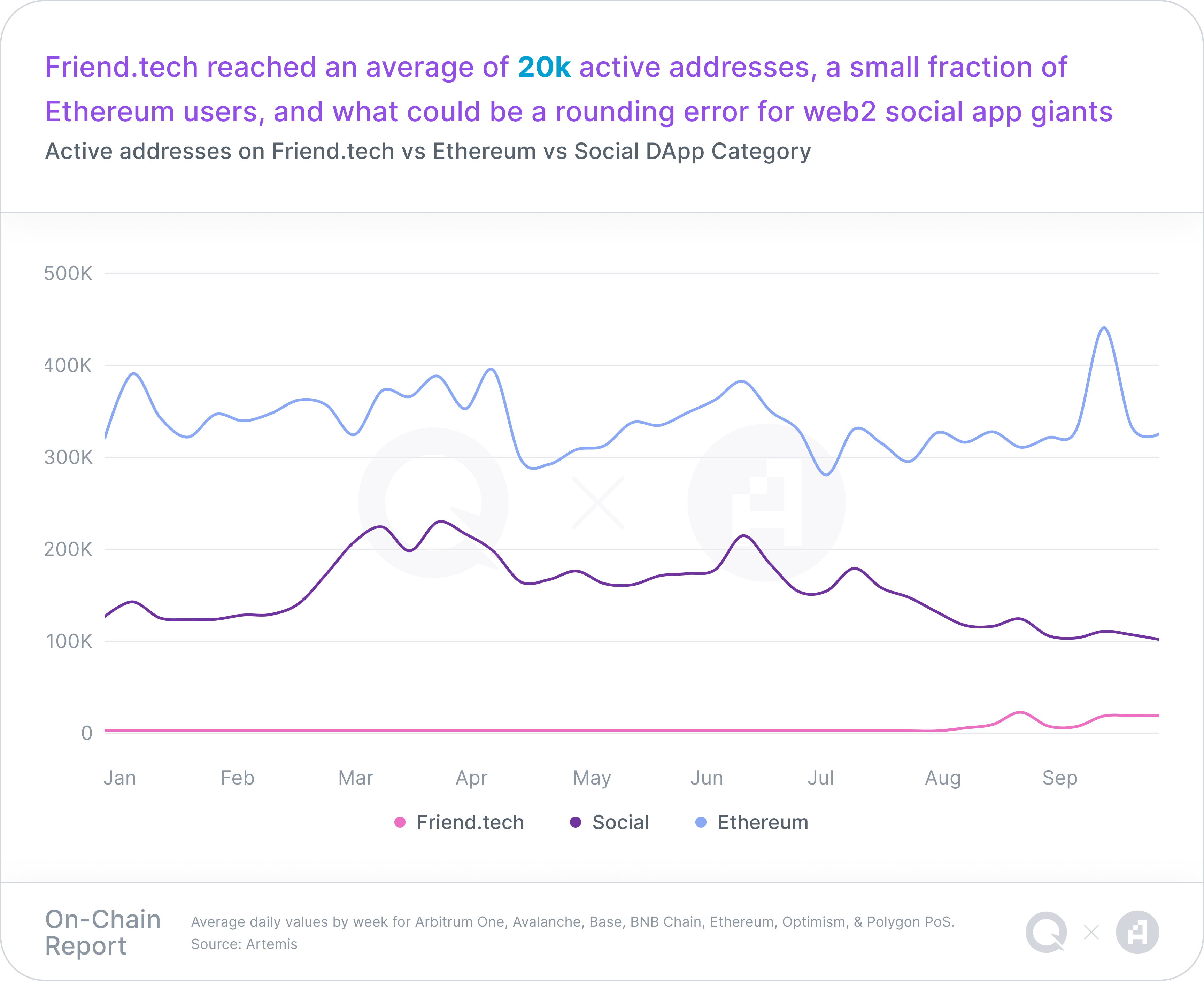

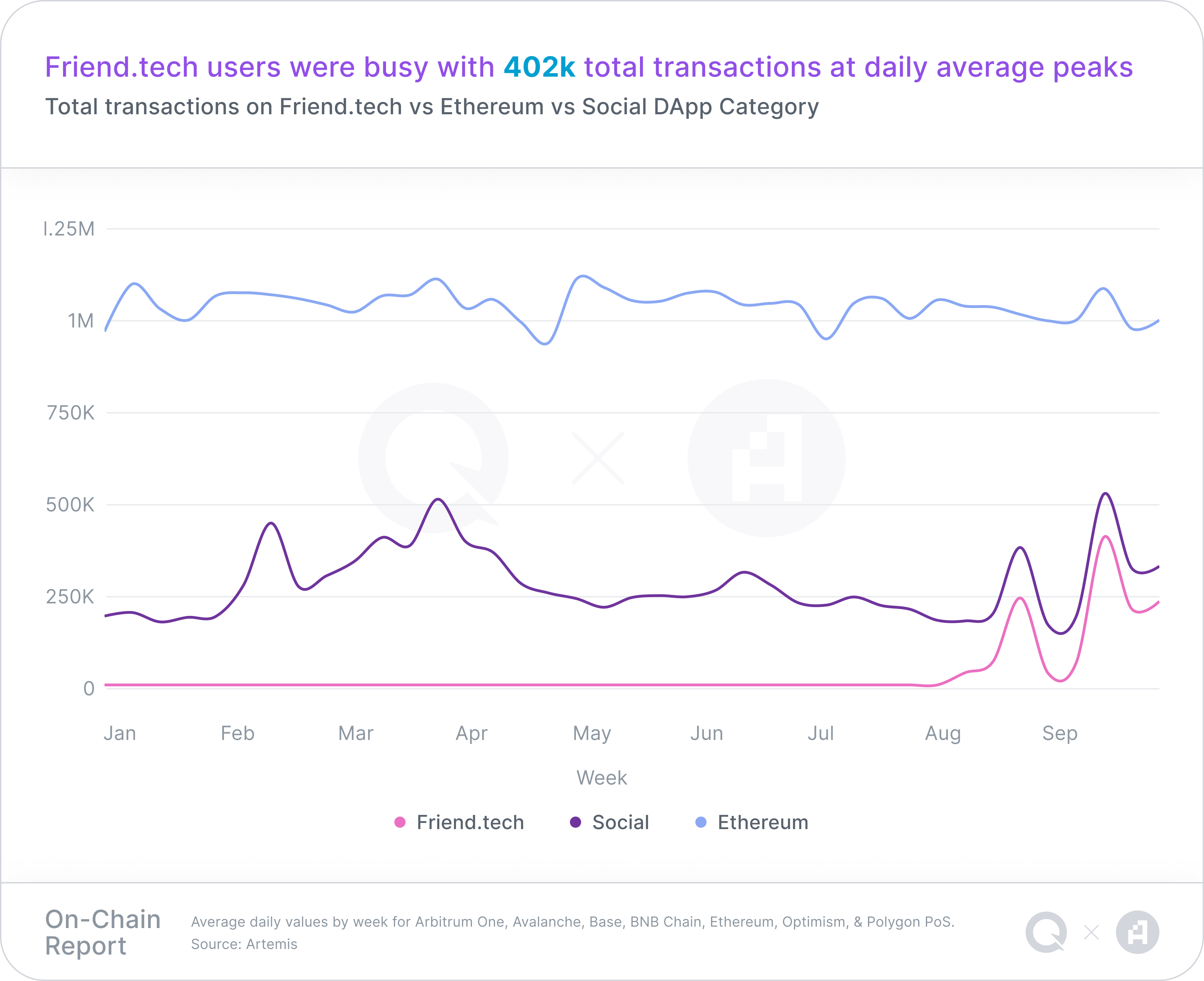

Key takeaways: Social DApps

- Friend.tech saw single-day peaks of 20k Active Addresses and 402k total transactions towards the end of the quarter.

- If Friend.tech had 2B DAUs like Facebook does now, that would add up to around 31B daily transactions. As DeSocial continues to grow and onboard new users, scaling solutions will be more important than ever.

Galxe

- The Web3 ethos of "community, not customers" wouldn't be possible without players like Galxe, providing community-building tools.

- In Q3, it peaked at over 277,000 daily transactions and had days with over 90,000 active addresses, proving its lasting impact beyond momentary trends.

Hooked Protocol

- A social and entertainment take on education, Hooked Protocol aims to be the driver for Web3 adoption.

- While down on the year, Hooked was still one of the most popular social platforms in Web3, crossing 150,000 transactions on July 6th across 132,000 unique addresses.

EVM Scaling Solutions

EVM scaling solutions are technologies implemented on the Ethereum blockchain to enhance its capacity and speed, enabling decentralized applications to efficiently manage increased user demand and transactions while maintaining low costs and prompt processing.

Key takeaways: EVM Scaling Solutions

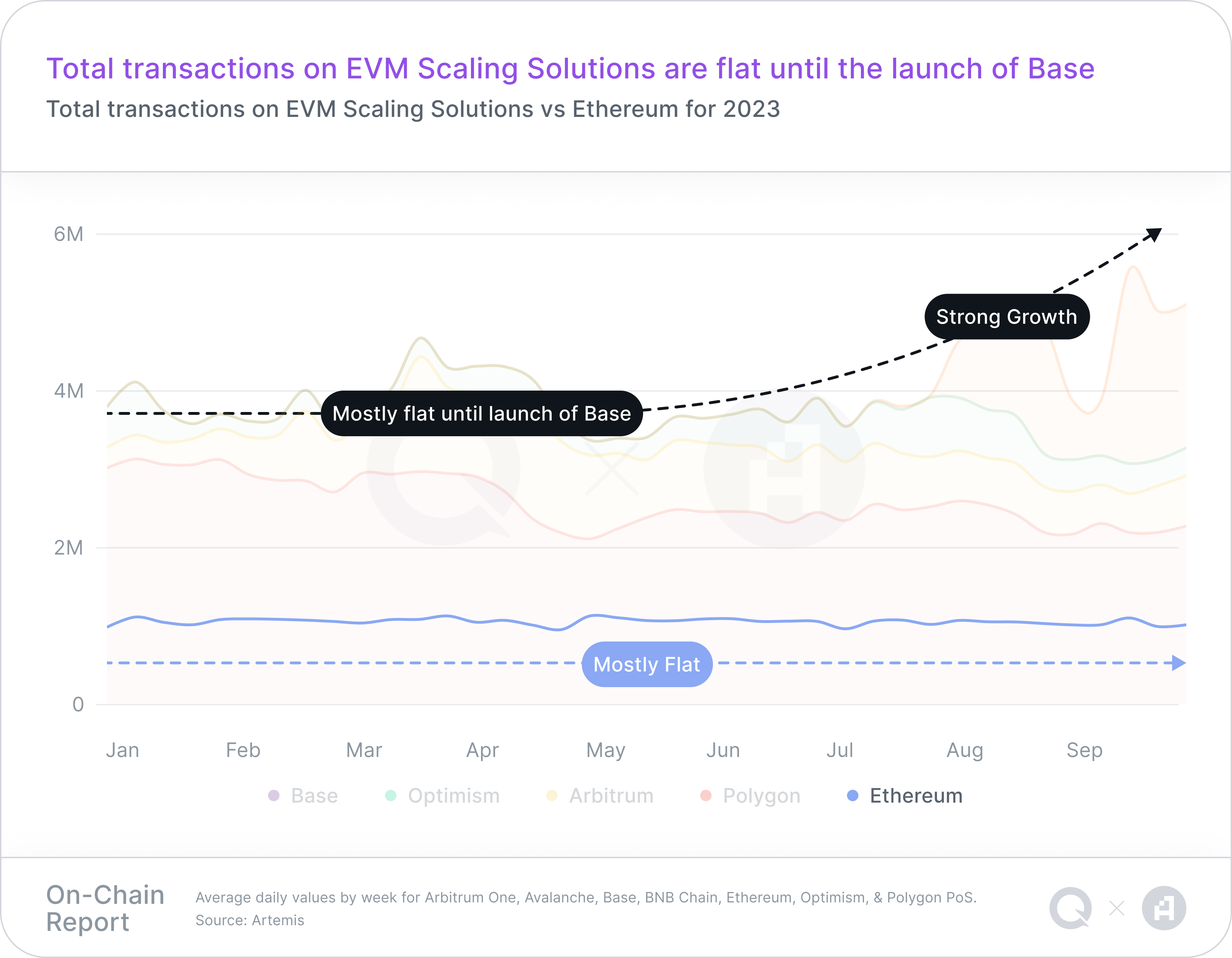

- Base was responsible for the most significant growth in the EVM scaling solutions during Q3.

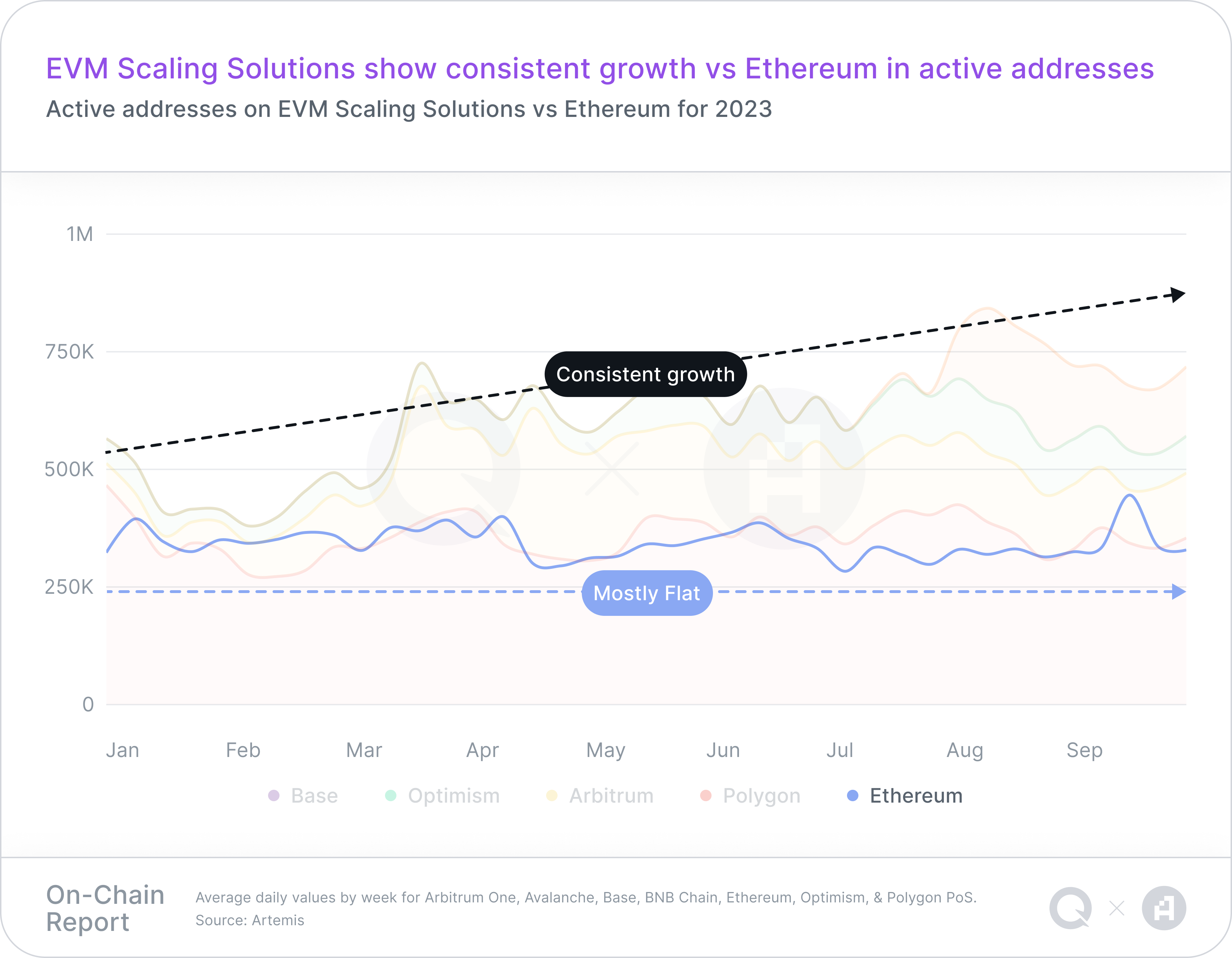

- EVM scaling solutions continue to show consistent growth in Active Addresses compared to Ethereum.

While EVM scaling solutions have continued to show strength, a protocol doesn't have to be tethered to Ethereum to succeed. Alternate Layer 1s like Solana and Tron demonstrate that success isn't limited to Ethereum-based Layer 2s or side chains.

Solana

- Solana prioritizes a single high-performance chain over multiple "app chains."

- In Q3, Solana consistently processed over 15m daily transactions, peaking at over 20m.

- Despite past outage criticisms, Solana's recent 7+ months of 100% uptime shows strength.

Tron

- Tron is another example of a highly performant chain with considerable user adoption.

- Averaging over 5M daily transactions in Q3, Tron saw a peak of over 7.2M on July 4th.

- Tron often led in daily active addresses, reaching a high of 2.6M on July 11th.

What are the emerging trends for the medium term?

Over the next year or two, several trends are expected to emerge within the Web3 landscape. By observing the open source developer activity, we're able to see EVM scaling as a standout, while technology launches are making noteworthy progress across social, tokenization, and wallet infrastructure.

These areas indicate that the near-term evolution of the ecosystem will be driven by the continuous refinement and expansion of core technologies and platforms. Layer 1 blockchains and scaling solutions will work together to enhance performance, security, and interoperability, fostering an environment conducive to widespread adoption. The development of essential infrastructure components, such as social graphs, tokenization, and wallet infrastructure will unlock the next stage of growth as global markets embrace crypto-spring.

Scaling Solutions and Their Growing Importance

As the adoption of blockchain technology continues to grow, scalability has emerged as a critical challenge that needs to be addressed to ensure the long-term success and broader integration of blockchains. The implementation of scaling solutions paves the way for a more efficient and accessible blockchain ecosystem, ultimately allowing for widespread integration into global industries. This supports the emerging narrative that even with the downward trends in developer activity, Layer 2 solutions are leading the charge toward adoption.

New EVM blockchains positioning themselves as an Ethereum scaling solution: Base, zkSync, zkEVM, Scroll, opBNB, and other Optimism-based projects. Developer activity is falling consistently across the blockchain ecosystem, with the only exception being OP Mainnet. This can be attributed to the open-source nature of the OP Stack and the fact that it's being adopted by projects like Base and opBNB. It should be noted that Zora is also based on the OP Stack — bucking the trend among NFT Marketplaces in previous section.

The Optimism Collective delivers a technology stack, developer experience, and incentive structure that builders trust for their projects. From core developers to hackers, builders choose OP Mainnet and the OP Stack because of a large and diverse contributor network, a robust network of Superchain partners, and Retroactive Public Goods Funding that expands their opportunities to build long term.

Polkadot

- Trailing only Ethereum, Polkadot surpasses other ecosystems in open-source development, with over 500 weekly active developers even during a Q3 market dip.

- Similar to Cosmos, Polkadot scales horizontally, fostering interoperable chain creation.

Polygon

- Polygon Labs introduced the Chain Development Kit, an open-source codebase for initiating ZK-powered L2 Ethereum chains.

- Polygon's app chain offering has seen traction with adopters like Immutable, Aavegotchi, Gnosis Pay, and more.

Decentralized Social

Social media is witnessing a potential paradigm shift with the emergence of blockchain-based platforms. Applications such as Friend.tech, Lens Protocol, Farcaster, and Link3 are attempting to redefine the way users interact, share content, and communicate by leveraging decentralized technologies. Blockchain-enabled social platforms offer enhanced privacy, data ownership, and user empowerment, potentially fostering a more equitable digital environment.

Following the success of Friend.tech, we're seeing lots of SocialFi copycats on different chains like Star Shares on Avalanche, Stars Arena on AVAX, Post.tech and Cipher.rip on Arbitrum, New Bitcoin City on Bitcoin, Friend3 on Binance, and Friendzy on Solana.

Lens Protocol

- In Q3, Lens announced Lens v2, giving us a glimpse of what's to come in Web3 social. V2 gives Lens-based apps significantly more power, enabling them to deeply integrate through "Open Actions" and improved monetization capabilities.

- Additionally, it offers users more versatility with ERC-6551's NFT-linked accounts and "Profile Manager" account abstraction features.

Dmail

- A consistent challenge is communicating with Web3 users, especially across their various identities and chains they leverage

- With thier cross-chain messaging. platform, Dmail took off in Q3 crossing 60,000 daily active addresses as a demonstration of the demand for cross-chain, cross-protocol infrastructure.

- Dmail serves as a sign of how to reach a broad Web3 audience and is a model we're sure to see replicated.

Tokenization

Real-world asset (RWA) tokenization is poised to take off in 2023, with companies such as Securitize receiving approval to roll out tokenized securities in Spain. In Europe, Swift and Chainlink are jointly experimenting with asset tokenization. At the same time, ETF applications are gaining traction in the US, with several companies seeking to launch tokenized ETFs.

These developments signify a maturation phase in blockchain asset tokenization, indicating a broader acceptance, especially in Real-World Assets (RWAs) like real estate, private equity, and art.

Avalanche

- Announced in Q3, the Avalanche Foundation has set up a fund of $50m to purchase tokenized assets minted in their ecosystem.

- Already the home of the tokenized KKR fund, Avalanche is shaping up to be an ecosystem to watch for asset tokenization.

Chainlink

- Chainlink, a top real-world data provider to blockchains, has recently forged significant partnerships, notably with finance heavyweight Swift for cross-border payments.

- In June 2023, Chainlink and Swift collaborated with major financial entities like DTCC, BNY Mellon, and Citi to assess tokenized asset transfers across blockchains.

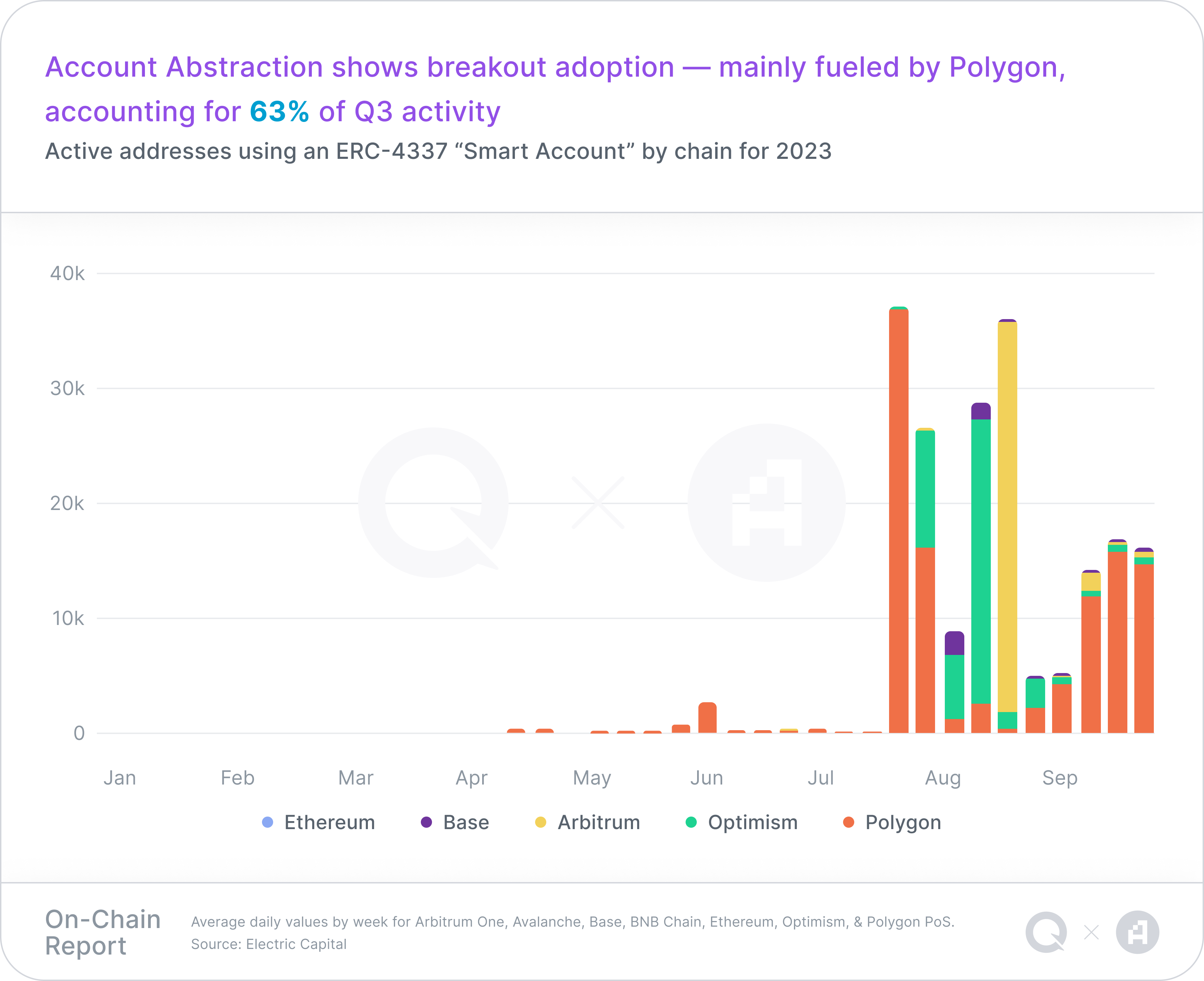

Account Abstraction & Wallets

Account Abstraction promises a smoother web2-like experience. In 2023, Ethereum caught up to chains like Starknet and zkSync that already provided native support for AA. In Q3, we saw a surge in adoption, notably on Polygon via Biconomy. We believe this to be an early sign of what is to come, bringing forth a new generation of user experience.

Leading into Q3, there was little innovation in the wallet space. This quarter we saw notable progress out of Metamask and Phantom. MetaMask's Snaps and Phantom's Shortcuts are two innovations that will unlock new ways to interact with the Web3 ecosystem natively within wallets.

Fireblocks

- Fireblocks has provided wallet-as-a-service solutions for longer than WaaS terminology has been around.

- In Q3, they launched an innovative non-custodial WaaS offering.

- While it's early days as to how we'll see this rolled out, Fireblocks has already onboarded large-cap institutions such as National Australia Bank and Flipkart onto its platform.

Circle

- Best known for their USDC stablecoin, Circle has come out strong in 2023 with their Web3 Services division, the debut service being their Programmable Wallets.

- It's clear Circle is committed to providing an expanding set of services in the space leveraging their prowess in stablecoin and enterprise-grade infrastructure.

What are VCs betting on for the long term?

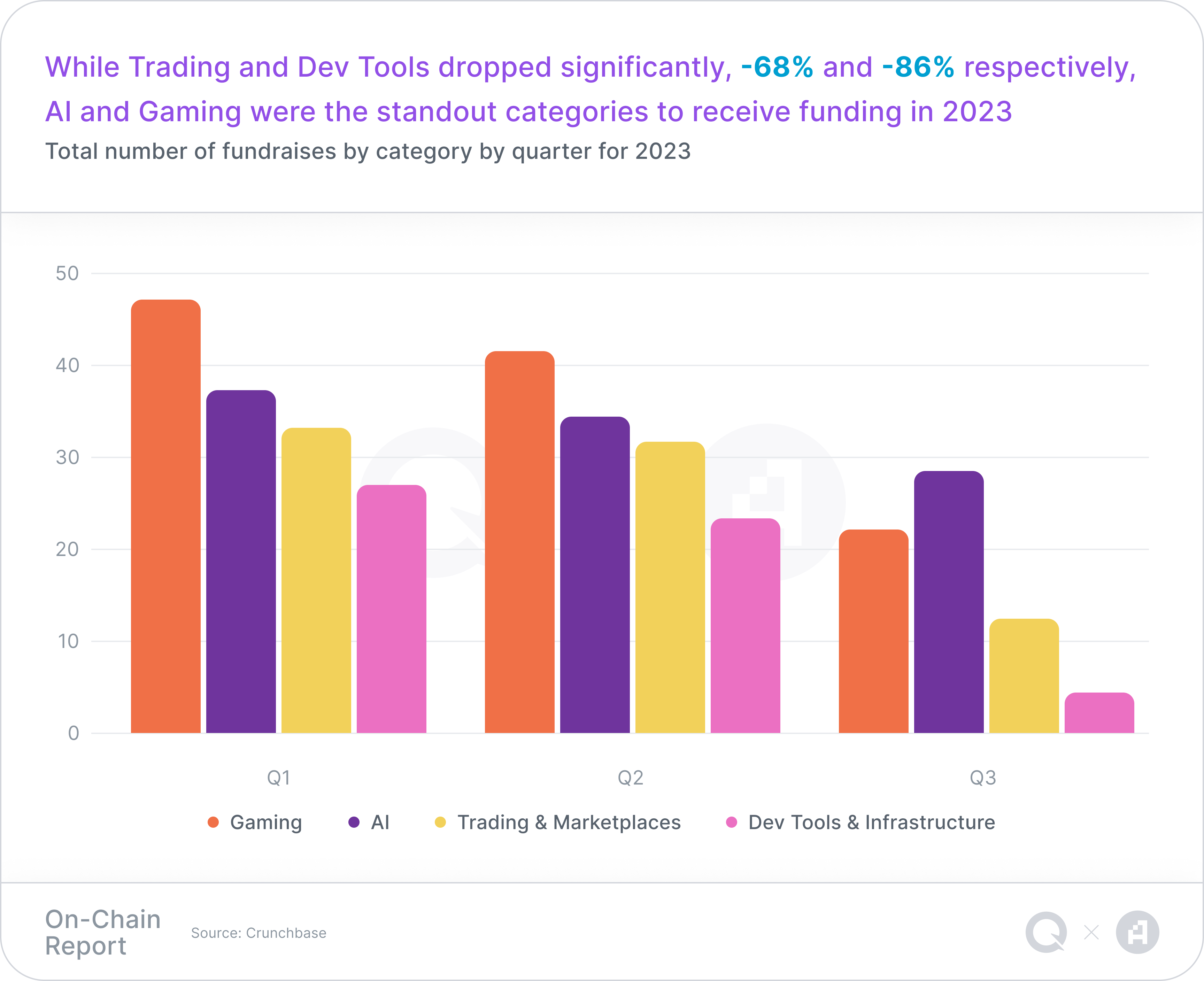

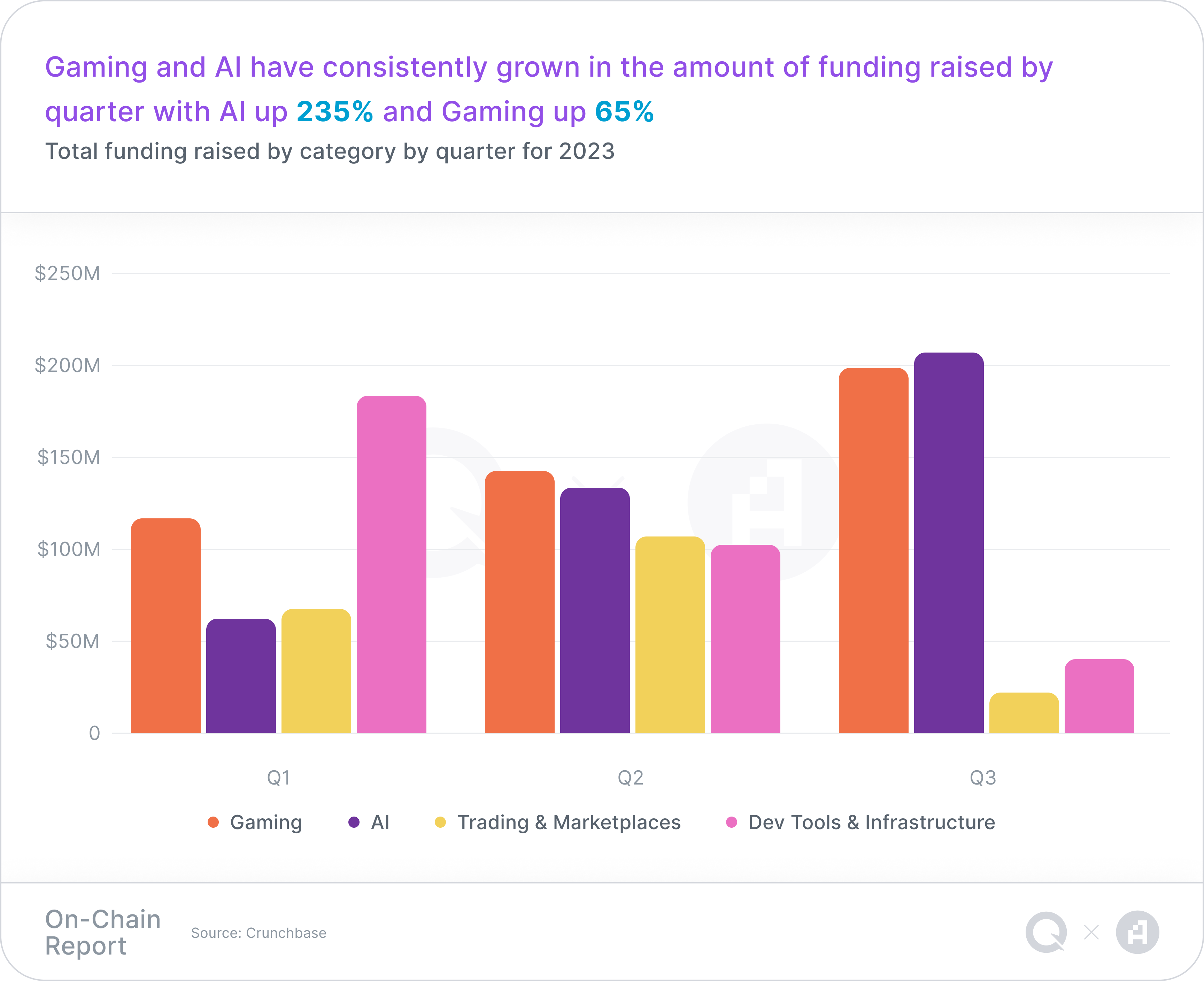

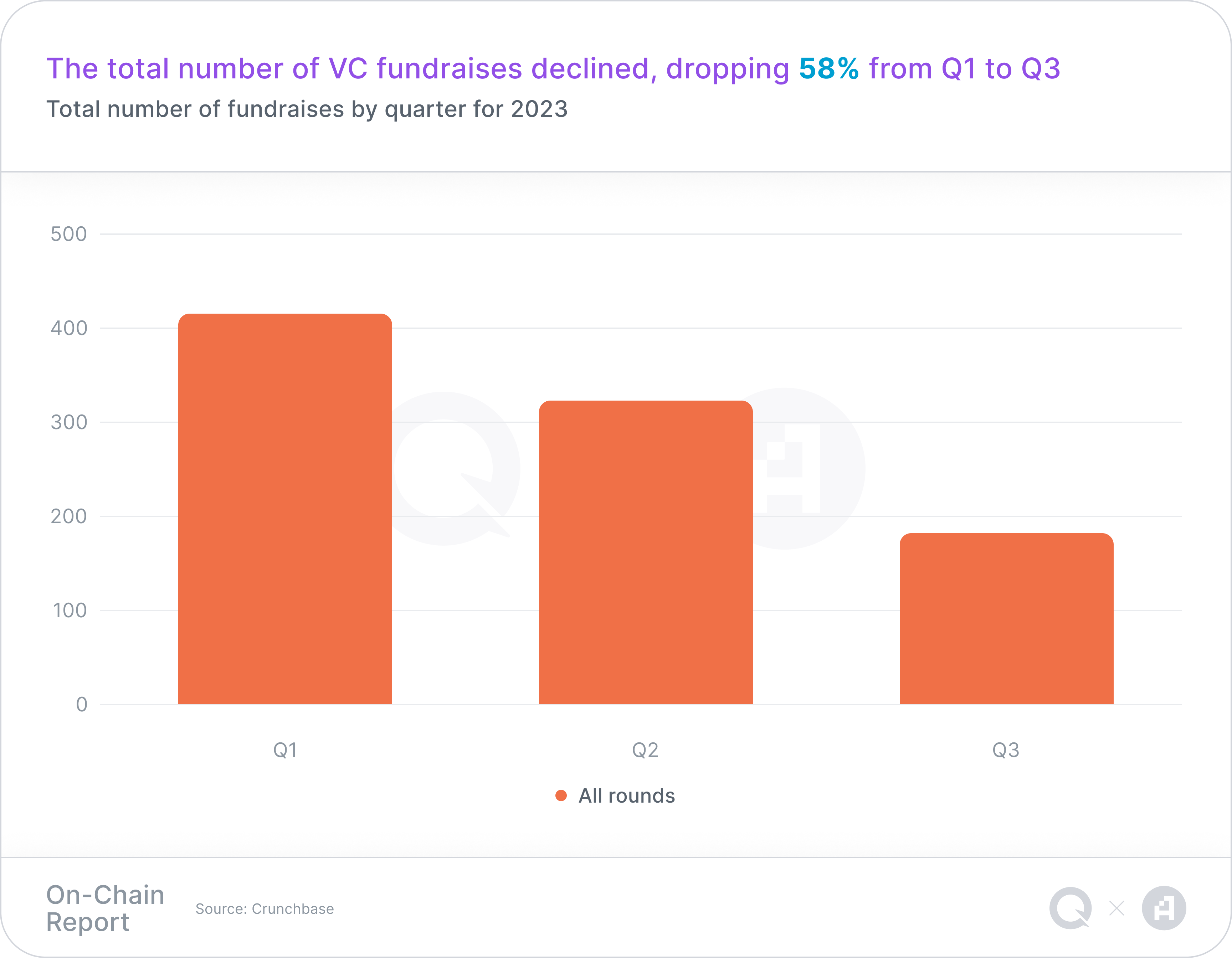

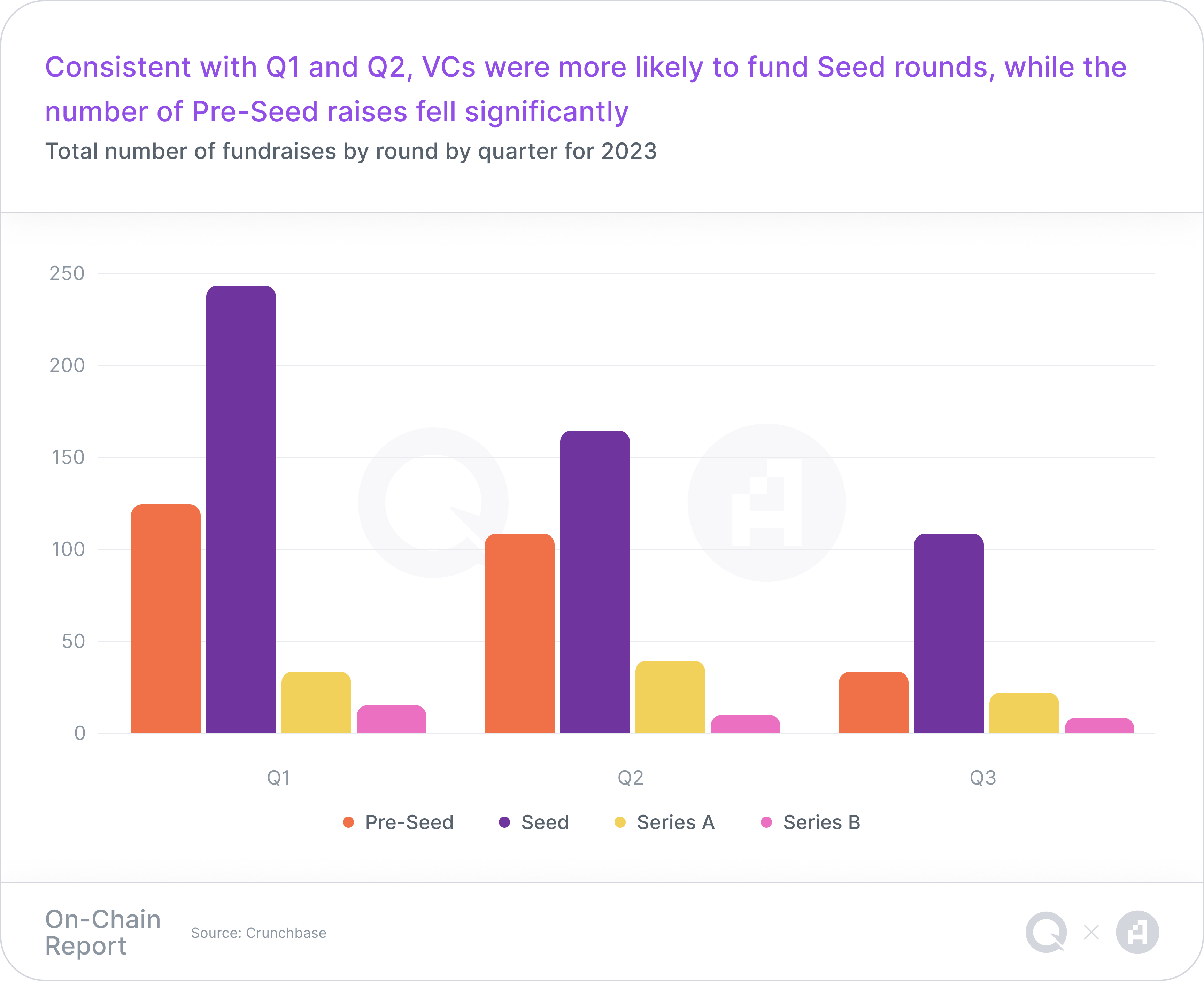

VC investments slowed in 2023, but didn't stop altogether. There are still strategic investments being made in the future of Web3. There are a few standouts like Gaming and AI that led Q3 investment categories.

Follow the money, a review of Q3 investments

Web3 investments have slowed meaningfully in 2023, but there were still standout narratives that emerged. For this report, we focused primarily at the seed to series B stages, which are expected to have significant impact on the blockchain landscape over the last term. Investment categories span a wide range of industries, including financial infrastructure, consumer applications/social, gaming, and Web3 infrastructure. These deals highlight the continued growth and maturation of the cryptocurrency ecosystem.

- Gaming and AI bucking the trend

- Seed round attracted the majority of raises

While all categories have seen a quarter-over-quarter decline in the number of deals, gaming and AI have consistently grown in the amount of funding raised.

Flashbots

- In Q3, Flashbots distinguished itself as one of only three Series B raises, securing $60M at a $1B valuation.

- Flashbots stands out as an innovator focused on mitigating the Maximum Extractable Value (MEV) challenges prevalent in the Ethereum network.

Cosmic Wire

- Cosmic Wire, a Web3 startup offering tools like 3D architecture and AI-driven avatars for metaverse development, secured $30M in seed funding.

- Investments from the Solana Foundation and Polygon make Cosmic Wire the first cross-chain funded Web3 company.

VC Sentiments for the Future

VC sentiment highlights a burgeoning era of consumer social experimentation fueled by crypto advancements and efficient transactions. Key focus areas include innovative solutions, strategic market approaches, sustainable financial practices, and ensuring future growth through diversified leadership and equipping them with appropriate tools and ethos.

We spoke with top firms in the space to get their view on the future:

The combination of improved mobile crypto UX, cheap transaction costs on Layer 2 environments, embedded wallet architectures, bonding curves for simplifying economic activity, and progressive web apps (PWAs), have led to a renaissance in consumer social experimentation. The dawn of crypto social products is upon us and we expect a number of breakouts over the next year.

We are excited to see a steady stream of founders continue to enter and build innovation that will propel the next wave of Web3 adoption. The most promising startups are those who are not only solving for a real existing problem, but also have truly thought out their go-to-market strategy, are being smart about burn rate, and have a strong monetization plan that will outpace strong projections of Bitcoin and other digital assets.

As the infrastructure in this field continues to evolve, I'm excited to see an increasing number of applications deliver consumer value and widen the aperture for sharing value with users. Our goal is to cultivate diversity in the next generation of leaders, by giving them the right tools and a shared ethos to confidently navigate uncharted territory.

In observing the web3 developer stack’s evolution, we’re stepping into a new era where the once ubiquitous high friction in onchain user interactions is gradually becoming a relic of the past. This clever abstraction is molding a world where engaging with crypto applications feels more intuitive, more seamless. The thoughtful development of infrastructure like Privy, Farcaster, and many more is emblematic of this transformation, igniting a range of innovative, frictionless use cases.

At Archetype, we’re fervently nurturing this progression, investing in a landscape of inventive solutions and seamless user experiences, marking a notable stride towards a more decentralized future.

Wrap-up

In Q3 2023, blockchain activity showcased a vibrant and expanding ecosystem, setting new benchmarks for innovation and user adoption. This surge underscores a promising trajectory for the decentralized future, with Web3 technologies playing a major role.

About QuickNode

Since its founding in 2017, QuickNode has emerged as the go-to solution for businesses and innovators requiring world-class blockchain development tools for speed, reliability, and security. Handling over eight billion blockchain requests daily, QuickNode boasts a 2.5X faster response time than competitors and 99.99% uptime across 24+ chains and 35+ networks. With a user-friendly interface and a robust multi-chain developer tool suite, QuickNode is an ideal choice for top Web3 businesses and global brands.

About Artemis

Since launching in 2022, Artemis has emerged as a premier institutional data platform for digital assets. Delivering insights across 25+ blockchains, Artemis stands out as the definitive data science layer for crypto fundamental information. From sector-specific metrics to real-time developer engagement insights, Artemis ensures that users are equipped with the most comprehensive and customizable digital asset data available. With its wide availability of data ingestion choices, from Excel integrations to Snowflake Data Shares, Artemis is the data platform of choice for global financial institutions and investors.

Did you enjoy the report?

Sign up for email updates on the evolving Web3 landscape.

.png)

%20Investment%20amount%20by%20round-png.png)