6 min read

Overview

Staking SOL is an important way to incentivize users to secure the Solana network. Doing so, however, limits your ability to use your tokens and restricts liquidity on the network. Liquid staking solves this problem by allowing you to stake your SOL while still maintaining the ability to use a proxy for your tokens. This guide will cover what liquid staking is and how to stake SOL in a staking pool.

What You Will Learn

- What is Liquid Staking

- Overview of Solana's Stake Pool Program

- How to stake SOL in a staking pool

What You Will Need

- A basic knowledge of Staking on Solana (Guide: How to Stake SOL)

- A modern web browser (e.g., Google Chrome)

- A Solana wallet (e.g., Phantom)

- Some SOL tokens for staking and account rent/transaction fees

What is Liquid Staking

Liquid Staking is a way to stake your tokens while maintaining liquidity for participation in decentralized finance (DeFi). This is done by depositing SOL with a liquid staking pool. The staking pool maintains a target allocation of validators that they have vetted, and they stake your deposited SOL across the validator set. In return, you receive a proxy token (or liquid stake pool token) representing your staked SOL. Unlike staked SOL, this token is liquid and can be swapped, traded, transferred, and used in DeFi applications.

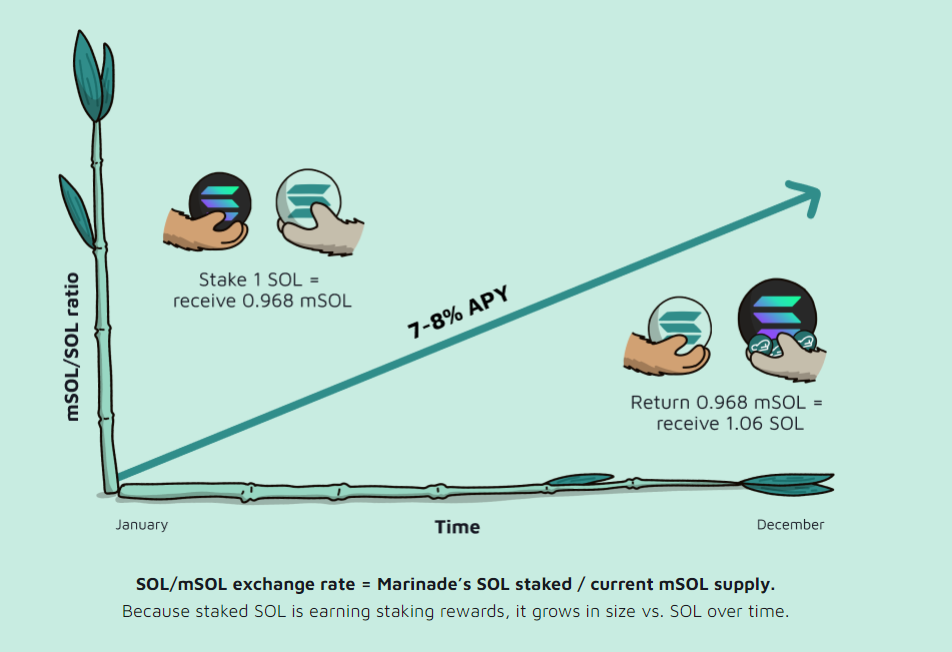

In a traditional stake account, you receive small SOL deposits after each epoch. In a liquid stake pool, your number of tokens stays the same, but each token's value (compared to SOL) increases as the underlying SOL is staked and earns rewards. In other words, the amount of SOL that can be redeemed from a liquid stake token should increase over time. Marinade, a popular liquid staking pool on Solana, has a helpful visual to show how this works:

Why do people choose to stake their SOL in a liquid staking pool? There are several reasons:

- Liquidity: Liquid staking pools allow you to stake your SOL while maintaining liquidity. This is important for users who want to participate in DeFi applications or be able to swap to other tokens quickly.

- Diversification: Liquid staking pools allow you to stake your SOL across a set of validators. This is important for users who want to diversify their staking risk.

- Convenience: Liquid staking pools allow you to stake your SOL without managing your own validator set. This is important for users who want to stake their SOL but want to avoid managing their own validator set.

- Network Security: Because many liquid staking pools stake across a set of validators, liquid staking can support network decentralization and overall network security.

Why might users choose not to stake their SOL in a liquid staking pool?

- Fees: Liquid staking pools charge fees for their services.

- Smart Contract Risk: Liquid staking pools are smart contracts. This means there is a risk of smart contract exploitation and the liquid staking token depegging from the underlying SOL.

- Validator Risk: With liquid staking, users trust a third party to manage their validator set. If the liquid staking pool is not well managed, there is a risk of funds being allocated to a poorly performing validator set (lower yield) or a malicious validator set (slashing risk).

Solana Stake Pool Program

The Solana Stake Pool Program is a Solana program "for pooling together SOL to be staked by an off-chain agent running a Delegation Bot which redistributes the stakes across the network and tries to maximize censorship resistance and rewards." (Source: Solana Stake Pool Program Documentation). In short the program (ID: SPoo1Ku8WFXoNDMHPsrGSTSG1Y47rzgn41SLUNakuHy) creates a standard for teams to stand up staking pools, implement validator allocation strategies, collect fees, and deposit/withdrawal funds from the pool.

The program is open source (Project GitHub) and has been audited by several security firms. The program is the standard for liquid staking pools on Solana.

To learn how to create your own Liquid Staking Pool, check out our Guide: How to Create a Liquid Staking Pool on Solana.

Liquid Staking Pools

There are several liquid staking pools on Solana. Though the functionally is quite similar, each has its unique validator set (size, yield, quantity, distribution, etc.), functionality (e.g., JitoSOL uses maximal extractable value, MEV, to arbitrage transactions for higher yield), fee structures, and DeFi integrations. Some of the largest liquid staking pools at the time of this writing are:

| Name | Token |

|---|---|

| Marinade | mSOL |

| Lido | stSOL |

| Jito | jitoSOL |

| Jpool | jSOL |

| Blaze Stake | bSOL |

| Socean | scnSOL |

A full list of Stake Pools can be found on community-maintained validator pages:

How to Liquid Stake SOL

Liquid staking is quite simple. Most staking pools have a web interface that allows you to deposit SOL in exchange for a liquid stake token. Let's look at how to do it using Marinade (other protocols follow a very similar process with their own UI).

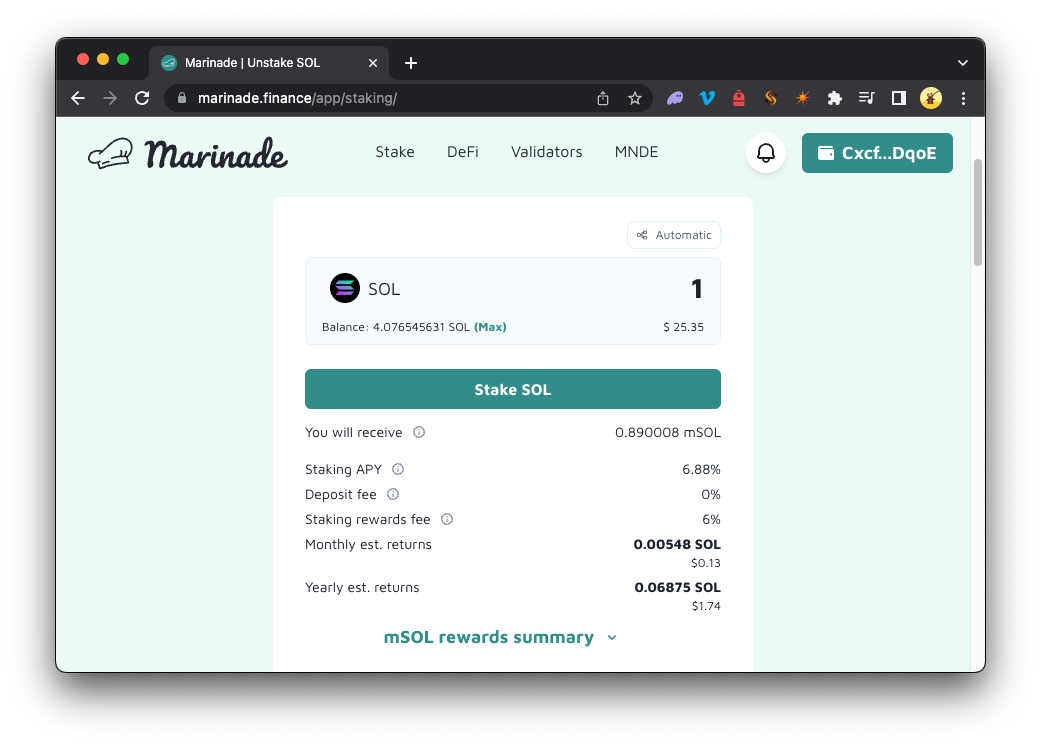

First, we are heading to Marinade's Staking page. Most staking pool sites have a simple UI for depositing and withdrawing SOL. Enter the amount of SOL you wish to stake, and the UI should estimate the amount of mSOL you should receive. When Marinade launched, 1 mSOL cost 1 SOL. Because the value of staked SOL increases over time, the price of mSOL has increased, so our 1 SOL is only yielding about 0.89 mSOL:

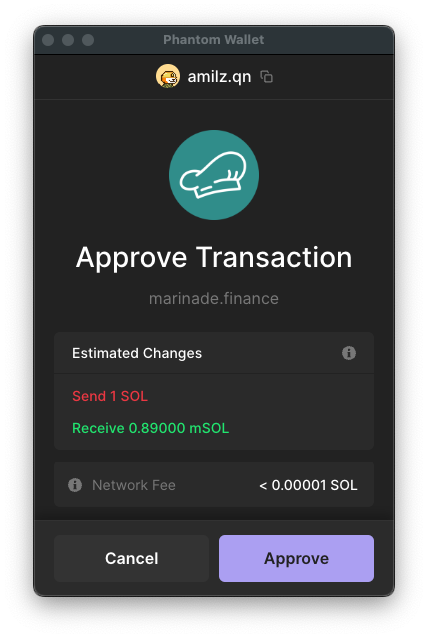

Click "Stake" and confirm the transaction in your wallet:

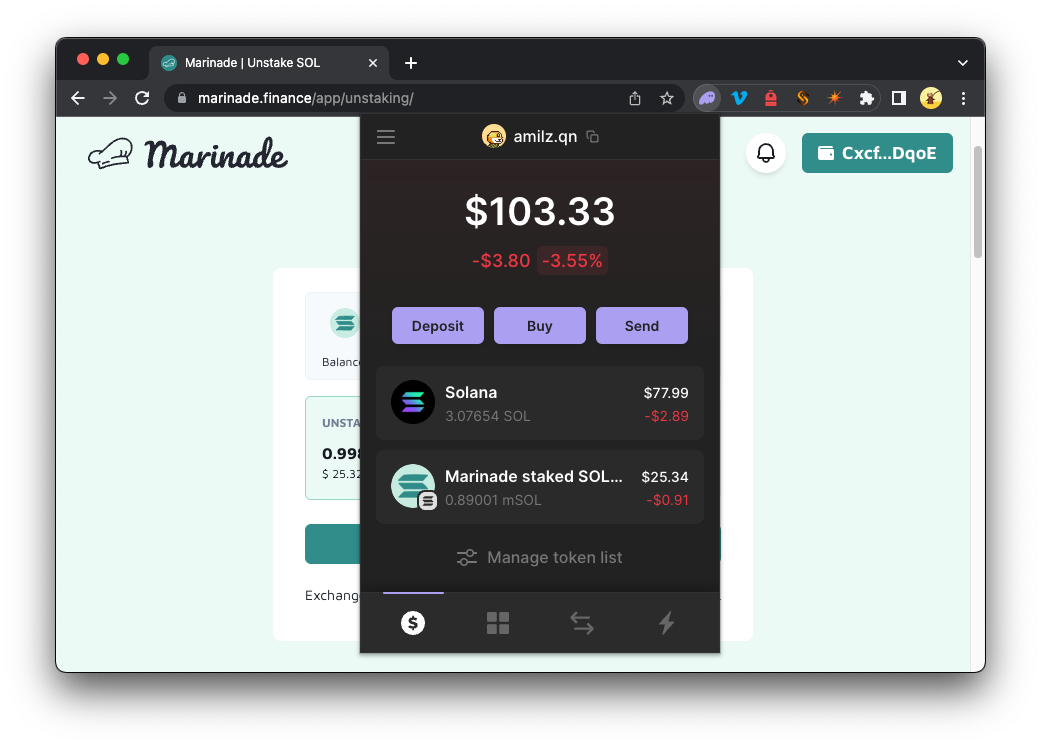

Once the transaction is confirmed, you should see your mSOL balance in your wallet as a liquid SPL token!

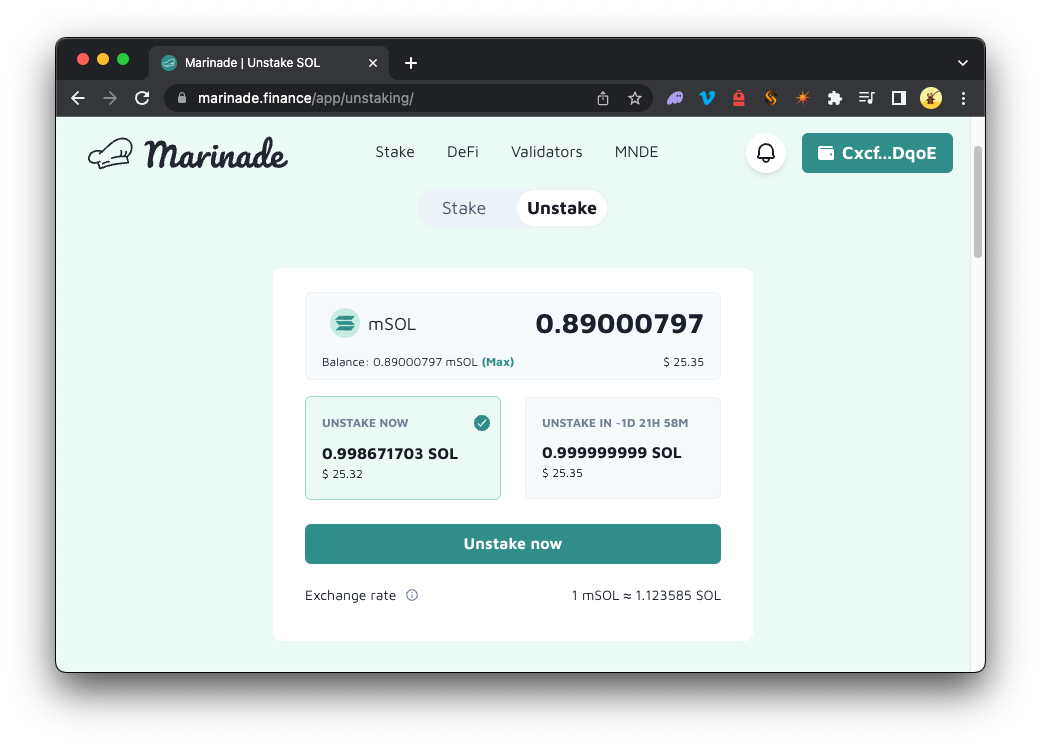

Finally, you should see your mSOL balance reflected on Marinade's Unstake page:

You should see that to unstake the full amount, there is a delay period (until the end of the epoch). You can also unstake for a small fee at any time.

This process is pretty standardized across most liquid staking pools. Here are a few examples:

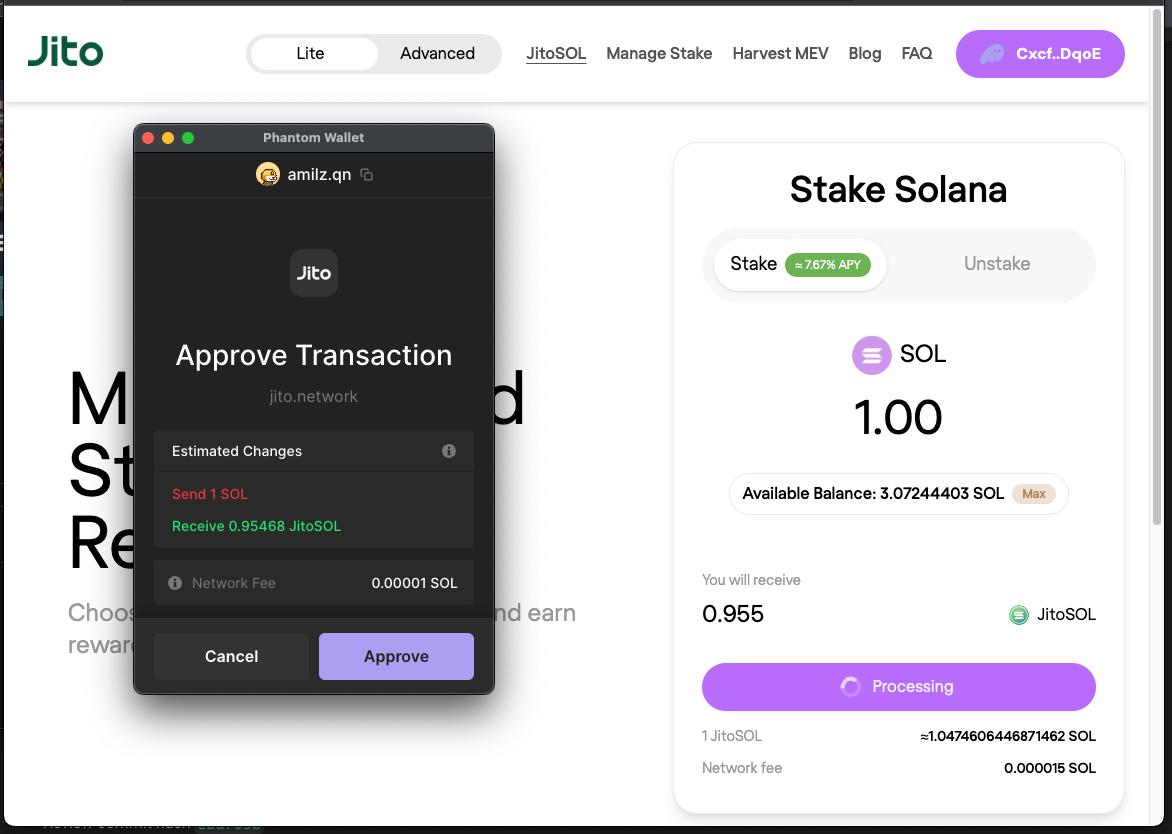

Jito

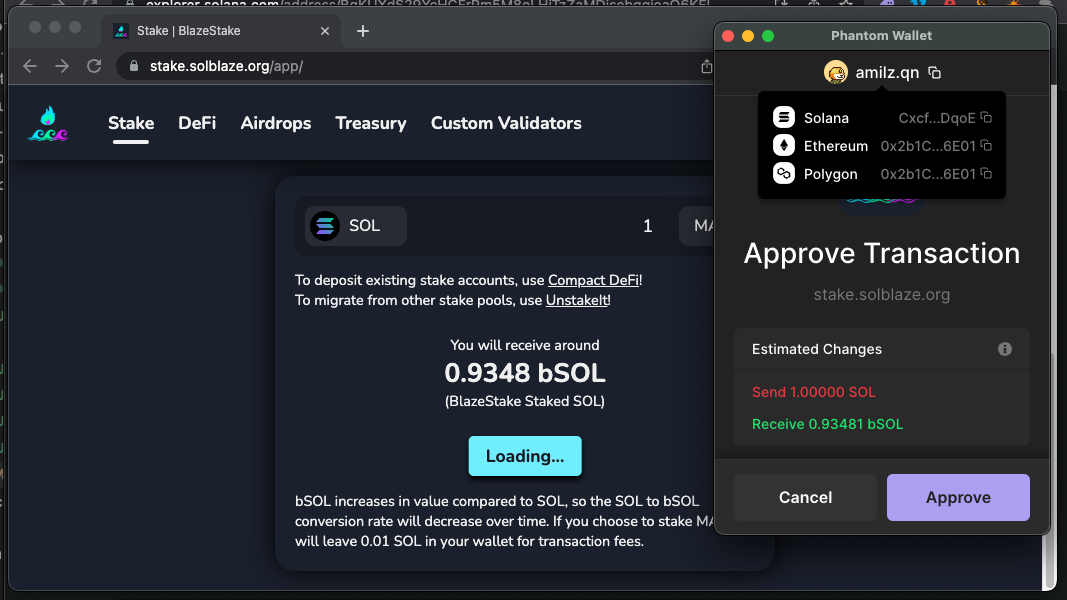

Blaze Stake

How to Use Liquid Staking Tokens

Liquid staking tokens are just SPL tokens. This means you can use them in any application that supports SPL tokens. Let's look at how to use mSOL in a couple of standard applications.

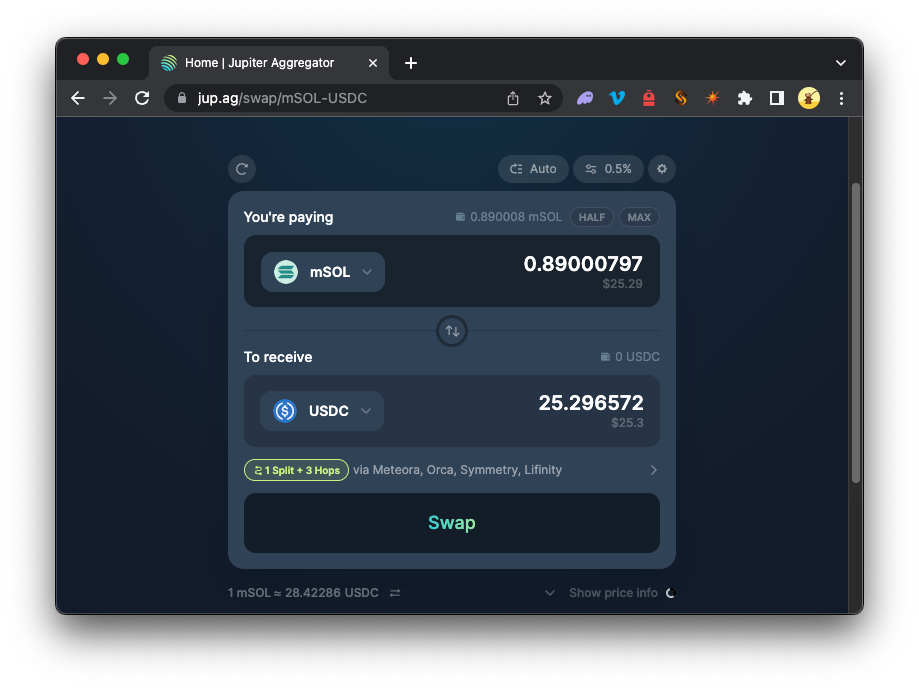

Swap Using Jupiter

Jupiter is a Swap UI for Solana. It allows you to swap between native SOL and any SPL tokens. Let's take a look at how to swap between mSOL and USDC. Head over to the Jupiter Swap page and connect your wallet. If not already selected, choose the tokens you want to swap from and to. You should see mSOL in your list of tokens. Remember this is a unique value of liquid staking--if your SOL tokens were natively staked, they would be locked, and you would not have access to them until you have unstaked them. Select the number of tokens you want to swap and click "Swap". We are swapping all of our recently staked mSOL for USDC:

Even though we staked our SOL, we could immediately use our mSOL on Jupiter to swap for USDC because we chose liquid staking.

DeFi Using Marinade

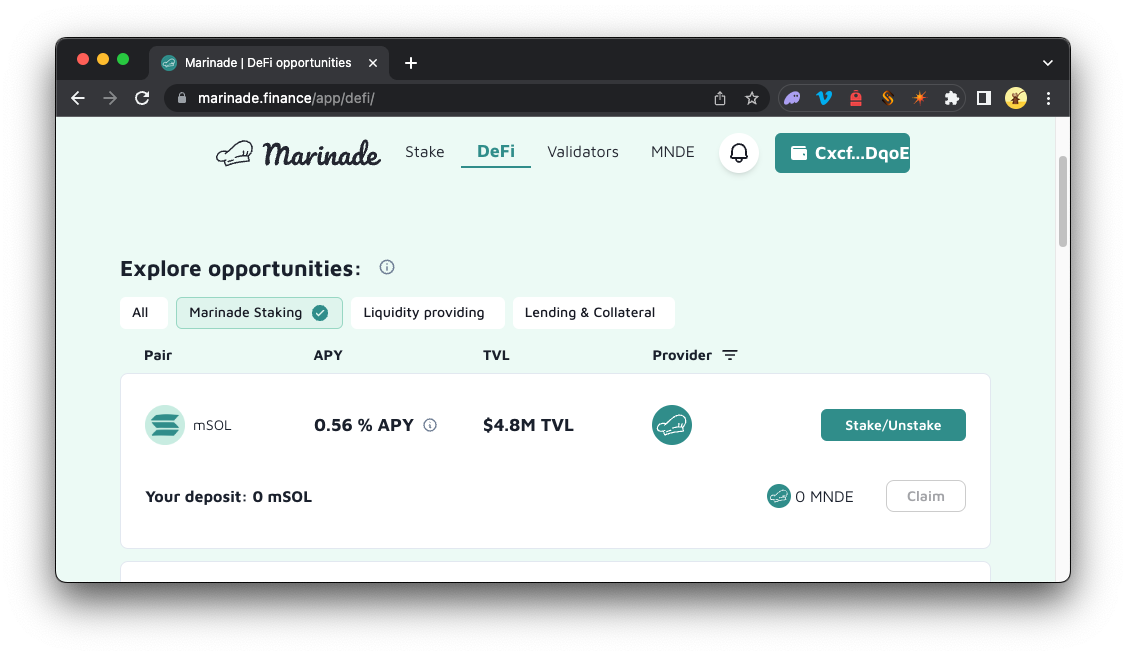

From Marinade's DeFi Page, we can see many DeFi integrations that allow us to use our mSOL to earn yield on our new mSOL (by providing liquidity, staking, lending, etc.). For simplicity, let's click the filter for "Marinade Staking" (these are DeFi protocols managed by the Marinade team):

We should now have options to:

- Stake our mSOL for MNDE tokens (the governance token of the Marinade protocol)

- Add liquidity for mSOL-SOL trading pairs

- Stake mSOL-SOL LP tokens for MNDE tokens

If you are new to DeFi, do not worry. We will keep it simple for this example. To learn more about DeFi, check out our Guide: What is Defi.

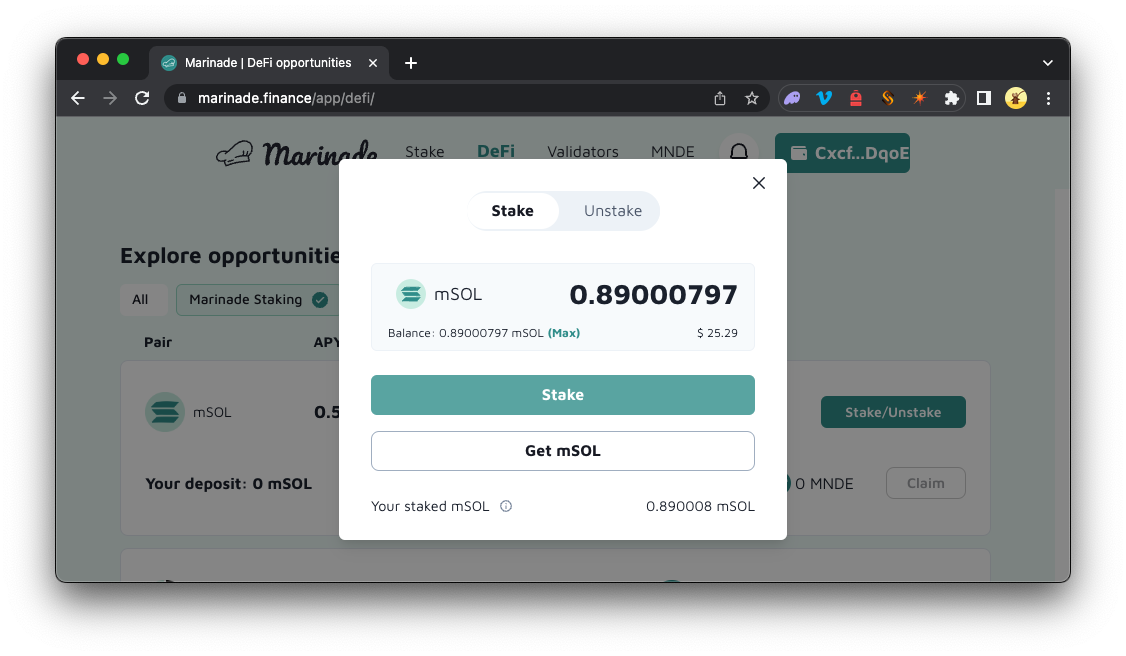

To stake our mSOL, we can click "Stake/Unstake" and enter the amount of mSOL we would like to stake and click "Stake":

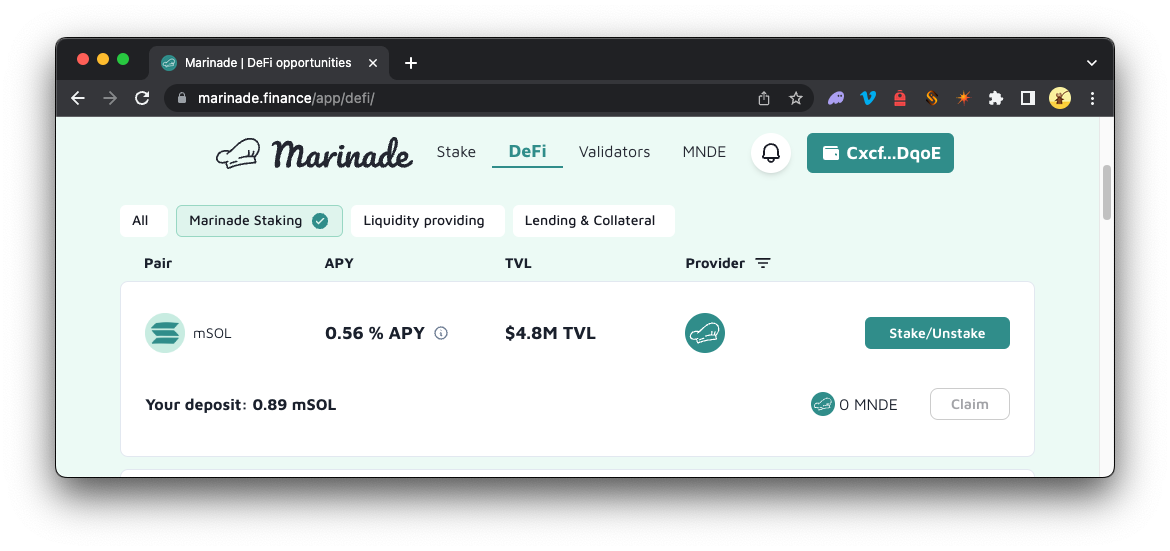

Our mSOL balance is reflected in the "Your deposit" field. We can also see our earned MNDE balance (currently 0), which we can claim once there is a balance. We are now earning additional yield on our mSOL!

This is just a simple example of what is possible with liquid staking tokens. You can use them across many DeFi protocols and dapps on Solana. A few examples include:

- Orca - Concentrated liquidity

- Tulip - Yield farming, strategy vaults, lending

- Mango Markets - Margin trading

- Meteora - Stablecoin liquidity, Lending, AMM pools

- Kamino Finance - Concentrated Liquidity

- marginfi - Borrowing and lending

Wrap Up

Staking SOL is an excellent way to help secure the Solana network while earning rewards. Liquid staking enables you to do so while maintaining liquidity and maintaining access to Solana DeFi protocols.

Got questions or want to learn more? Check us out on Twitter and Discord. We'd love to hear what you are up to!

We ❤️ Feedback!

Let us know if you have any feedback or requests for new topics. We'd love to hear from you.